Put Calendar Spread - Web put calendar spread. Web you’ll keep this credit here, 75 cents. Web there are two types of long calendar spreads: Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. The most you can lose in the trade is a $1.25, so not a huge risk. As a reverse calendar spread it will buy puts in the near. This strategy will focus on puts. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Web a calendar spread is a strategy used in options and futures trading: Web what is a calendar spread?

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is a strategy used in options and futures trading: Roll short strike vertically fortunately, we are options investors who know how to make. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web a calendar spread is an options or futures strategy established by simultaneously entering.

Calendar Put Spread Options Edge

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. It is important to understand that the risk profile of a calendar spread is identical. Put calendar spreads are neutral to bullish short. Web reverse calendar put spread: First you use the sell to open order to.

Bearish Put Calendar Spread Option Strategy Guide

This strategy is one that you can. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a calendar spread is a strategy used in options and futures trading: Web put calendar spread. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable.

Bearish Put Calendar Spread Option Strategy Guide

Put calendar spreads are neutral to bullish short. Roll short strike vertically fortunately, we are options investors who know how to make. First you use the sell to open order to write puts based on the particular. It is important to understand that the risk profile of a calendar spread is identical. As a reverse calendar spread it will buy.

Glossary Archive Tackle Trading

Web put calendar spread. The most you can lose in the trade is a $1.25, so not a huge risk. Web there are two types of long calendar spreads: Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

First you use the sell to open order to write puts based on the particular. It is important to understand that the risk profile of a calendar spread is identical. Web you’ll keep this credit here, 75 cents. Roll short strike vertically fortunately, we are options investors who know how to make. A calendar spread typically involves buying and selling.

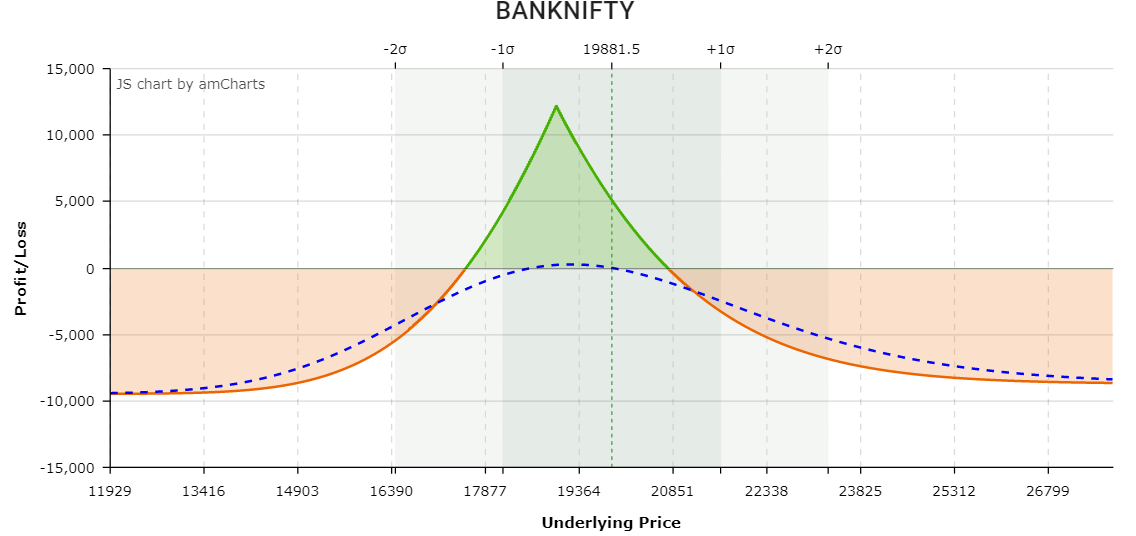

Long Calendar Spreads Unofficed

Web views today, we are going to look at a bearish put calendar spread on tsla. As a reverse calendar spread it will buy puts in the near. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. The most you can lose in the trade is.

Bearish Put Calendar Spread Option Strategy Guide

The most you can lose in the trade is a $1.25, so not a huge risk. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while. Roll short strike vertically fortunately, we are options investors who know how to make. As a reverse calendar spread it will buy puts in.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web reverse calendar put spread: Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while. This strategy will.

Bearish Put Calendar Spread Option Strategy Guide

This strategy will focus on puts. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. As a reverse calendar spread it will buy puts in the near. Web there are two types of long calendar spreads: Web reverse calendar put spread:

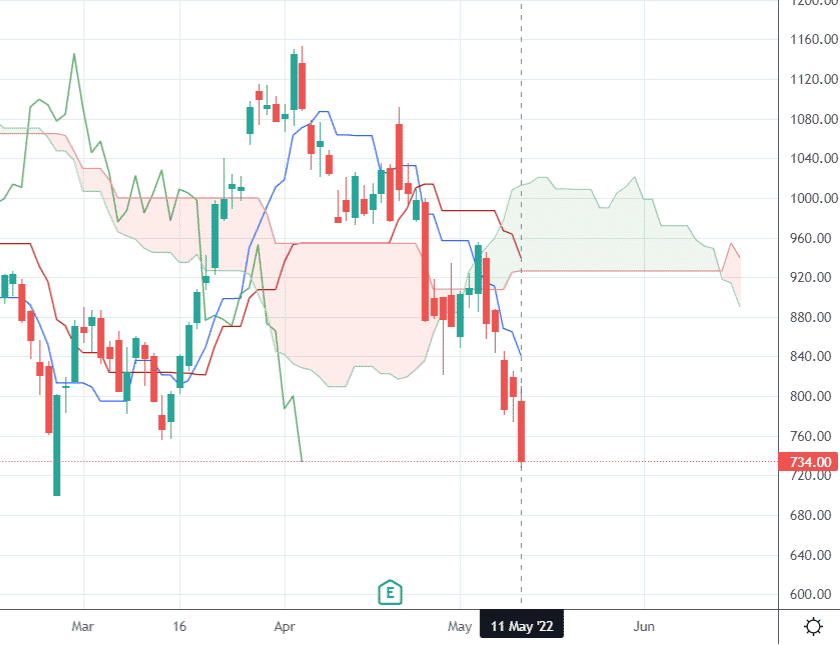

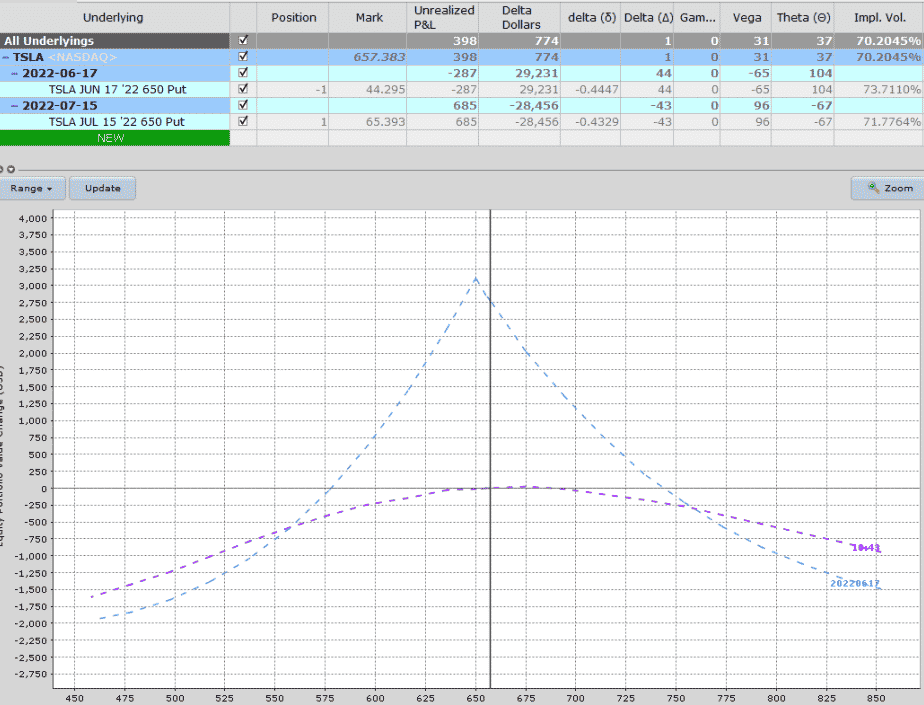

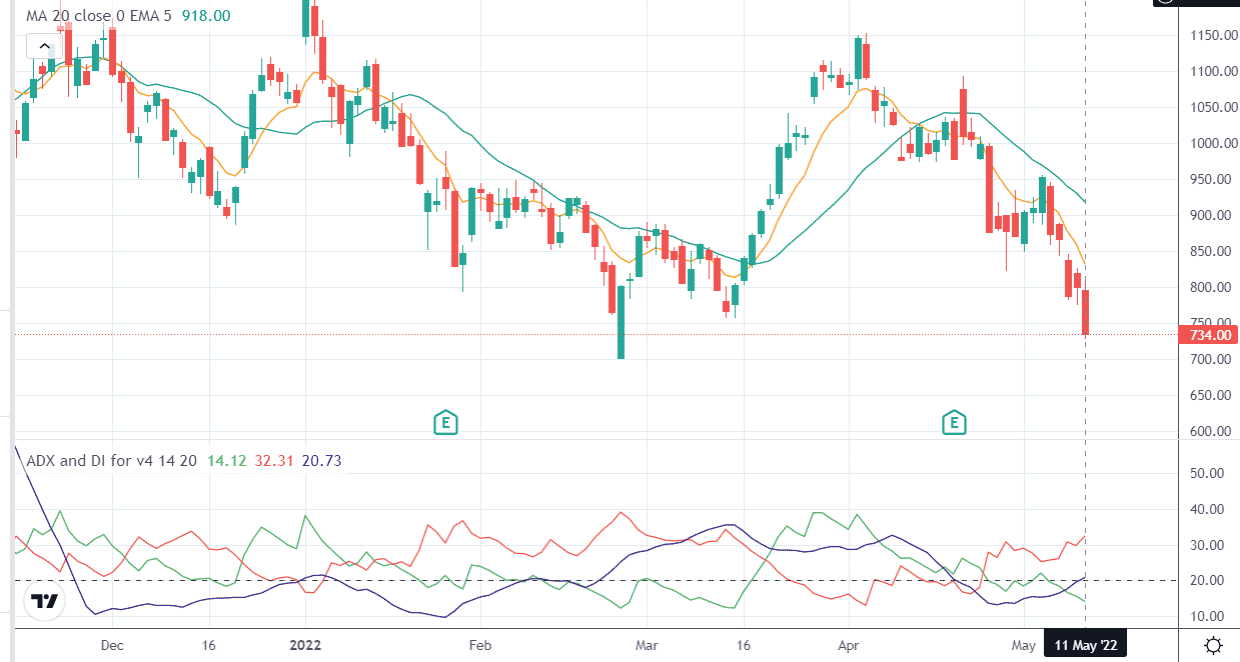

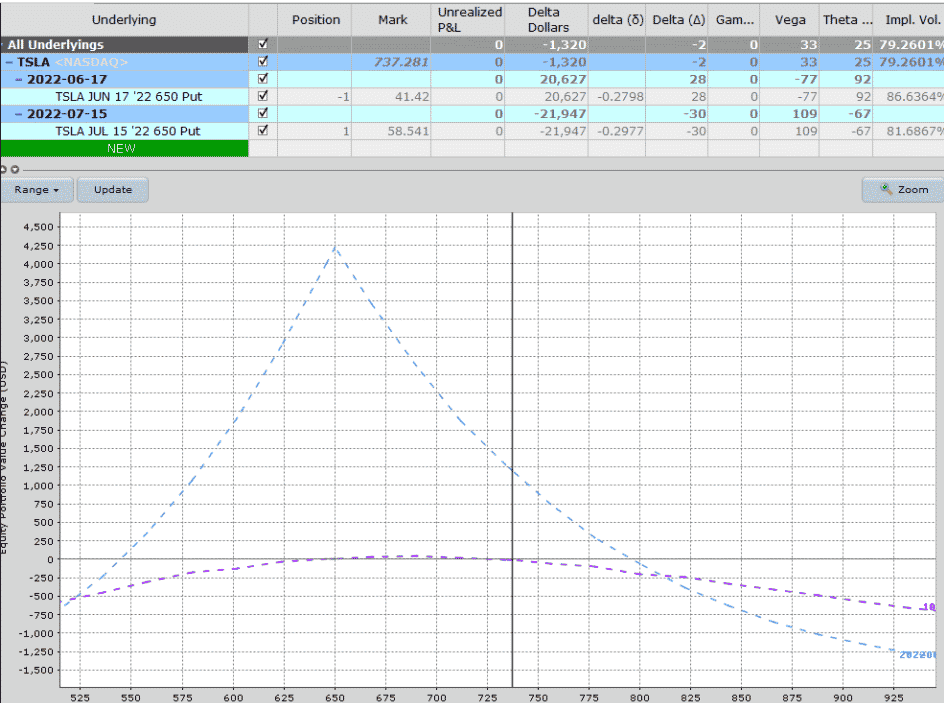

Web reverse calendar put spread: Web put calendar spread. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Web views today, we are going to look at a bearish put calendar spread on tsla. This strategy will focus on puts. It is important to understand that the risk profile of a calendar spread is identical. Web a calendar spread is a strategy used in options and futures trading: Web there are two types of long calendar spreads: Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web what is a calendar spread? There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. First you use the sell to open order to write puts based on the particular. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while. As a reverse calendar spread it will buy puts in the near. Web you’ll keep this credit here, 75 cents. The most you can lose in the trade is a $1.25, so not a huge risk. Roll short strike vertically fortunately, we are options investors who know how to make. Put calendar spreads are neutral to bullish short. This strategy is one that you can.

Web A Calendar Spread Is An Option Trade That Involves Buying And Selling An Option On The Same Instrument With The.

Web you’ll keep this credit here, 75 cents. Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. This strategy is one that you can. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

As A Reverse Calendar Spread It Will Buy Puts In The Near.

Web views today, we are going to look at a bearish put calendar spread on tsla. Web there are two types of long calendar spreads: Web reverse calendar put spread: Web what is a calendar spread?

A Calendar Spread Typically Involves Buying And Selling The Same Type Of Option (Calls Or Puts) For The Same Underlying Security At The.

Web put calendar spread. Web a calendar spread is a strategy used in options and futures trading: The most you can lose in the trade is a $1.25, so not a huge risk. Put calendar spreads are neutral to bullish short.

It Is Important To Understand That The Risk Profile Of A Calendar Spread Is Identical.

Roll short strike vertically fortunately, we are options investors who know how to make. First you use the sell to open order to write puts based on the particular. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)