Merger Model Template - Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal). Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the. A merger model is created to analyze the effects of two companies joining together. Web our beautiful, affordable powerpoint templates are used and trusted. Web value combined entities using dcf models. Web this is a hatnote template that proposes to merge the page it is applied to with one or more other pages. 50% cash and 50% debt vs…. M&a model inputs, followed by a range of m&a model. And the list goes on. Such as, two or more companies becoming one (merger).

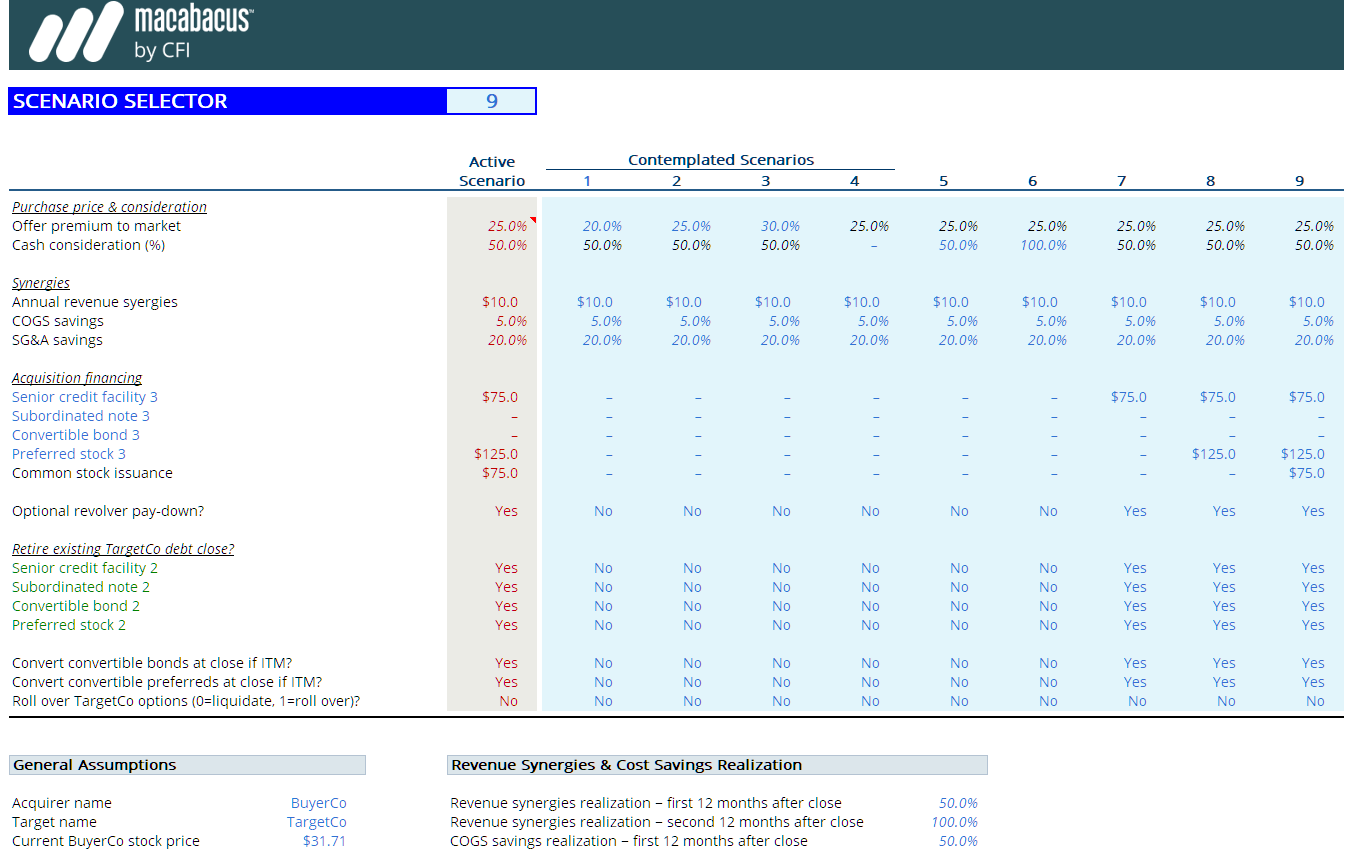

Merger Model Templates Macabacus

In a merger model, you combine the financial statements of the buyer and seller in an acquisition, reflect the effects of the acquisition, such as interest paid on new debt and new shares issued, and calculate the combined earnings per share (eps) of the new entity to determine whether or not the deal is viable. Web 33% debt, 33% stock,.

Post Merger Integration Framework By exMcKinsey Consultants Merger

A merger model is created to analyze the effects of two companies joining together. Web this is a hatnote template that proposes to merge the page it is applied to with one or more other pages. You can view a few sample m&a and merger model tutorials below: The macabacus merger model implements advanced m&a, accounting, and tax. 50% cash.

Merger Model M&A Excel Template from CFI Marketplace

Web this is a hatnote template that proposes to merge the page it is applied to with one or more other pages. The macabacus merger model implements advanced m&a, accounting, and tax. Web m&a and merger model examples. Cash, stock, or mix) step 3 → estimate the financing fee, interest expense, number of new share issuances, synergies, and transaction fee.

Merger Model StepByStep Walkthrough [Video Tutorial]

Web use the form below to get the accretion dilution excel model template that goes with this lesson: Web this is a hatnote template that proposes to merge the page it is applied to with one or more other pages. And the list goes on. Web 33% debt, 33% stock, and 33% cash vs. Cash, stock, or mix) step 3.

Merger Model, Factors affecting Merger Model, Steps in Merger Model

M&a model inputs, followed by a range of m&a model. Web step 1 → determine the offer value per share (and total offer value) step 2 → structure the purchase consideration (i.e. In a merger model, you combine the financial statements of the buyer and seller in an acquisition, reflect the effects of the acquisition, such as interest paid on.

Merger Model M&A Acquisition Street Of Walls

Web value combined entities using dcf models. And the list goes on. Web m&a and merger model examples. Web the key steps involved in building a merger model are: Web use the form below to get the accretion dilution excel model template that goes with this lesson:

Timeline Template of Mergers Model SlideModel

Web our beautiful, affordable powerpoint templates are used and trusted. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the. M&a model inputs, followed by a range of m&a model. And the list goes on. Web use the form below to get the accretion dilution excel model template.

Merger Model M&A Excel Template from CFI Marketplace

Web m&a and merger model examples. In this section, we demonstrate how to model a merger of two public companies. A merger model is created to analyze the effects of two companies joining together. Web home blog april 28, 2023 how to create a merger and acquisition model in excel facebook this tutorial shows how to. Web value combined entities.

Acquisition Integration Plan Template New Merger Integration Work How

Web anyone got a good free merger model template they'd feel comfortable sharing? Web the key steps involved in building a merger model are: Think about the “cost” of each method, start with the. A merger model is created to analyze the effects of two companies joining together. You can view a few sample m&a and merger model tutorials below:

Merger Model M&A Excel Template from CFI Marketplace

Web 33% debt, 33% stock, and 33% cash vs. 50% cash and 50% debt vs…. Such as, two or more companies becoming one (merger). A merger model is created to analyze the effects of two companies joining together. Web m&a and merger model examples.

50% cash and 50% debt vs…. Web this is a hatnote template that proposes to merge the page it is applied to with one or more other pages. Web a merger agreement may be used when one company purchases another, or when a struggling company seeks the refuge of a more. Web use the form below to get the accretion dilution excel model template that goes with this lesson: M&a model inputs, followed by a range of m&a model. Web anyone got a good free merger model template they'd feel comfortable sharing? Web the key steps involved in building a merger model are: In a merger model, you combine the financial statements of the buyer and seller in an acquisition, reflect the effects of the acquisition, such as interest paid on new debt and new shares issued, and calculate the combined earnings per share (eps) of the new entity to determine whether or not the deal is viable. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the. Web our beautiful, affordable powerpoint templates are used and trusted. And the list goes on. Such as, two or more companies becoming one (merger). Think about the “cost” of each method, start with the. Web step 1 → determine the offer value per share (and total offer value) step 2 → structure the purchase consideration (i.e. Mergers & acquisitions (m&a) modeling. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal). Web value combined entities using dcf models. A merger model is created to analyze the effects of two companies joining together. Web 33% debt, 33% stock, and 33% cash vs. Cash, stock, or mix) step 3 → estimate the financing fee, interest expense, number of new share issuances, synergies, and transaction fee

Web This Is The Term Use For Consolidation Of Businesses Or Their Assets.

In this section, we demonstrate how to model a merger of two public companies. Web the key steps involved in building a merger model are: Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the. Web our beautiful, affordable powerpoint templates are used and trusted.

You Can View A Few Sample M&A And Merger Model Tutorials Below:

Web use the form below to get the accretion dilution excel model template that goes with this lesson: Web 33% debt, 33% stock, and 33% cash vs. Web value combined entities using dcf models. In a merger model, you combine the financial statements of the buyer and seller in an acquisition, reflect the effects of the acquisition, such as interest paid on new debt and new shares issued, and calculate the combined earnings per share (eps) of the new entity to determine whether or not the deal is viable.

Think About The “Cost” Of Each Method, Start With The.

And the list goes on. The macabacus merger model implements advanced m&a, accounting, and tax. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal). Web a merger agreement may be used when one company purchases another, or when a struggling company seeks the refuge of a more.

A Merger Model Is Created To Analyze The Effects Of Two Companies Joining Together.

Web anyone got a good free merger model template they'd feel comfortable sharing? Web home blog april 28, 2023 how to create a merger and acquisition model in excel facebook this tutorial shows how to. Cash, stock, or mix) step 3 → estimate the financing fee, interest expense, number of new share issuances, synergies, and transaction fee Mergers & acquisitions (m&a) modeling.

![Merger Model StepByStep Walkthrough [Video Tutorial]](https://biwsuploads-assest.s3.amazonaws.com/biws/wp-content/uploads/2019/04/22161546/Merger-Model-Assumptions-1024x537.jpg)