Long Calendar Spread - A long calendar spread consists of two options of the same type and strike price, but with different expirations. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). Web the long calendar option spread can be entered by purchasing one contract and simultaneously selling. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to those who. Web a calendar spread is a time spread. Web a long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration. Web this article will focus on the two most common forms of time spread:

What Is A Calendar Spread

Web a calendar spread is a time spread. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in. Web what is a long calendar spread? Web the long calendar option.

How to Trade Options Calendar Spreads (Visuals and Examples)

Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term. Web this article will focus on the two most common forms of time spread: Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs,.

How to Trade Options Calendar Spreads (Visuals and Examples)

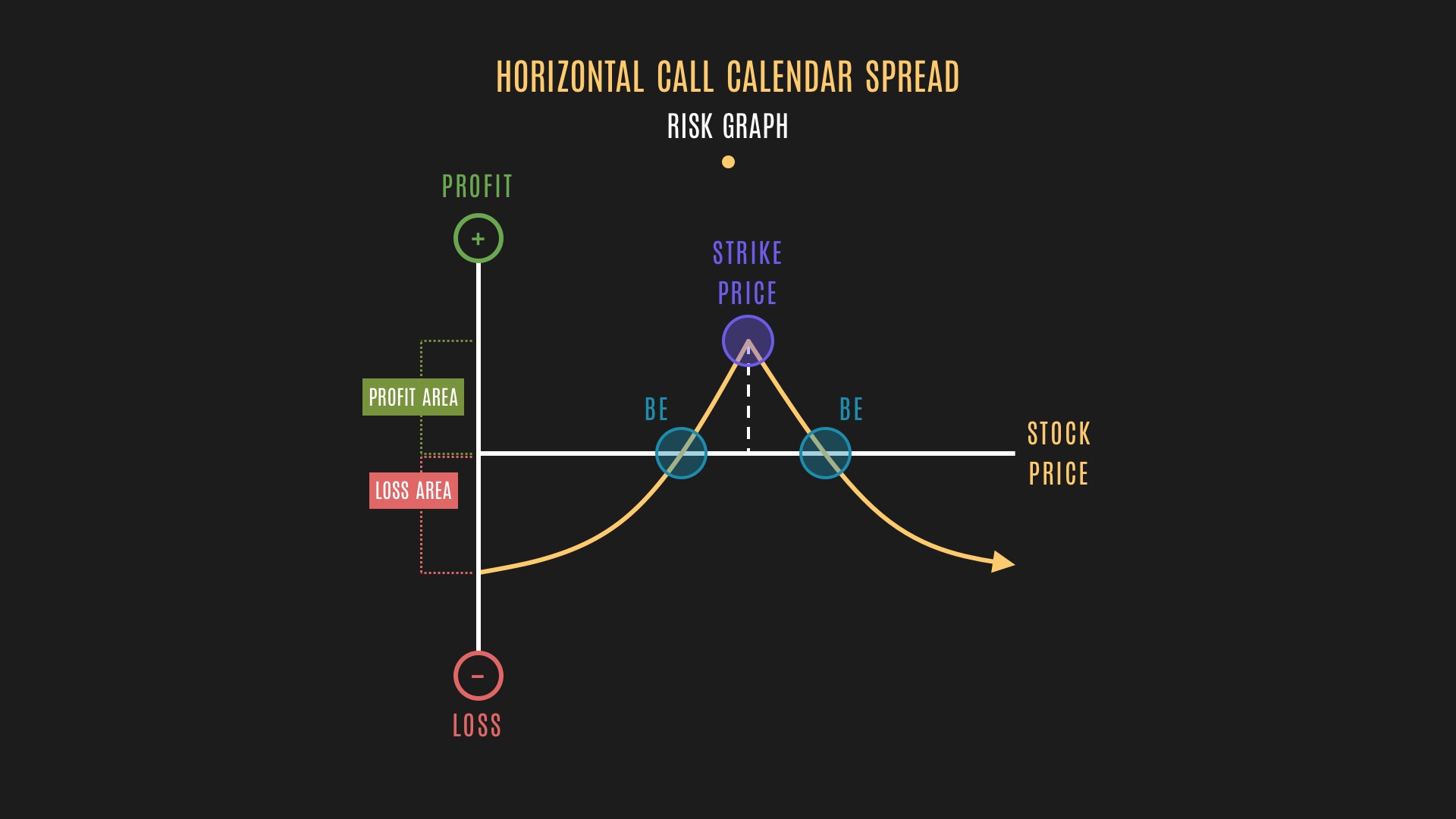

It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long.

Long Calendar Spreads for Beginner Options Traders projectfinance

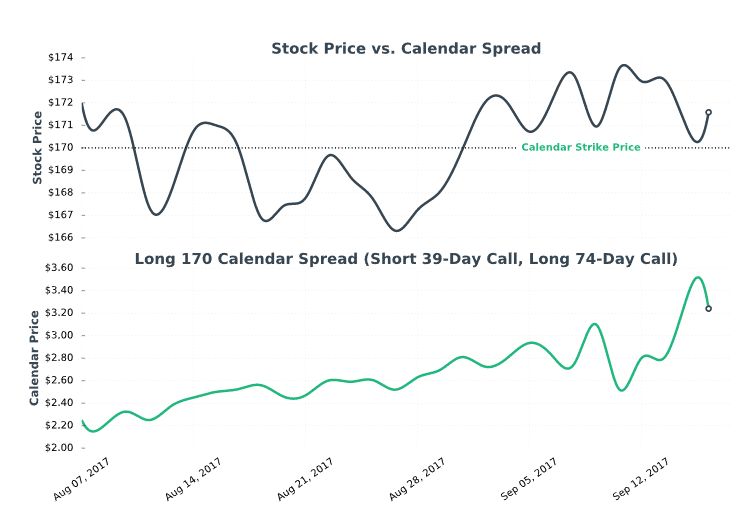

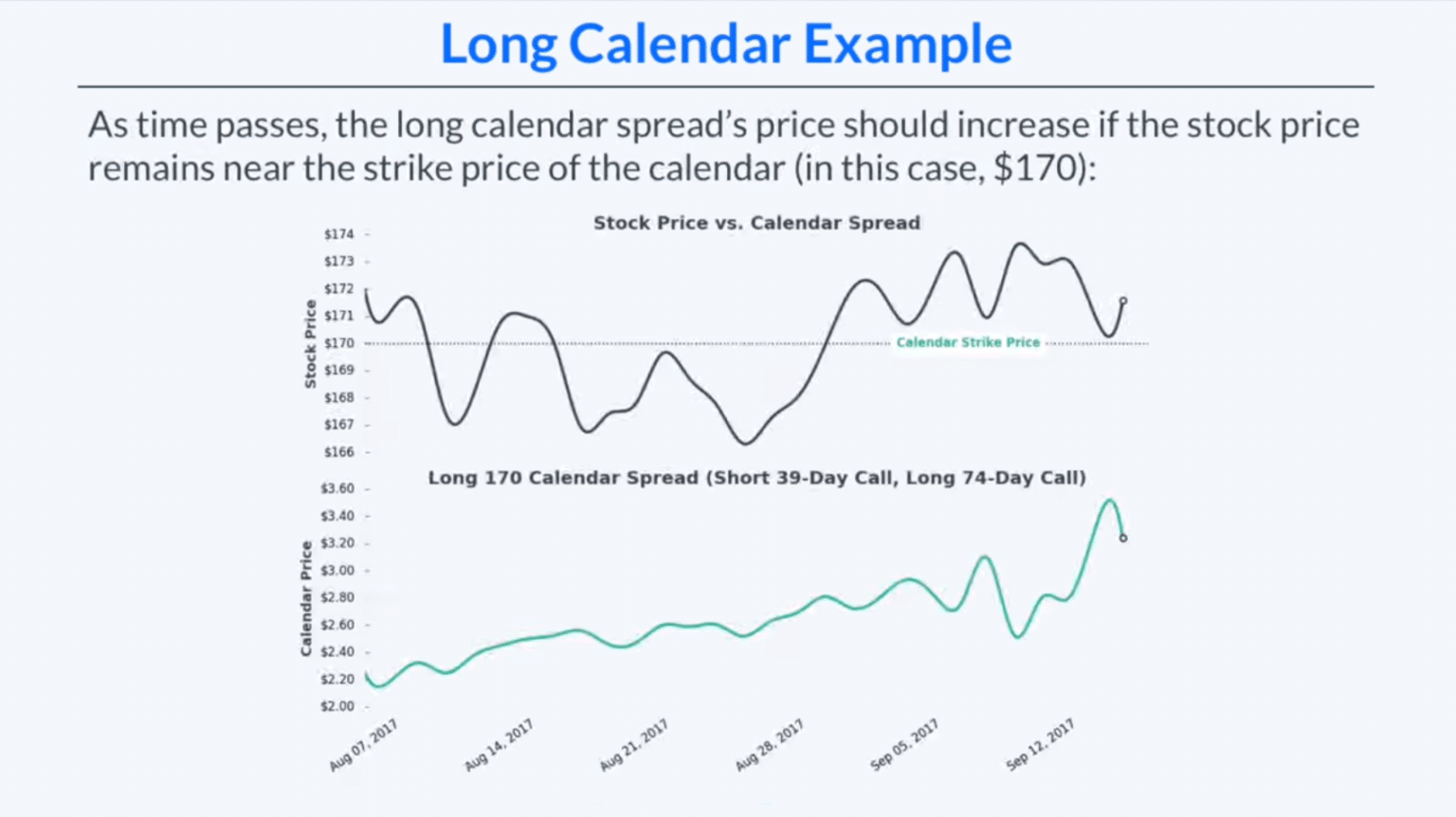

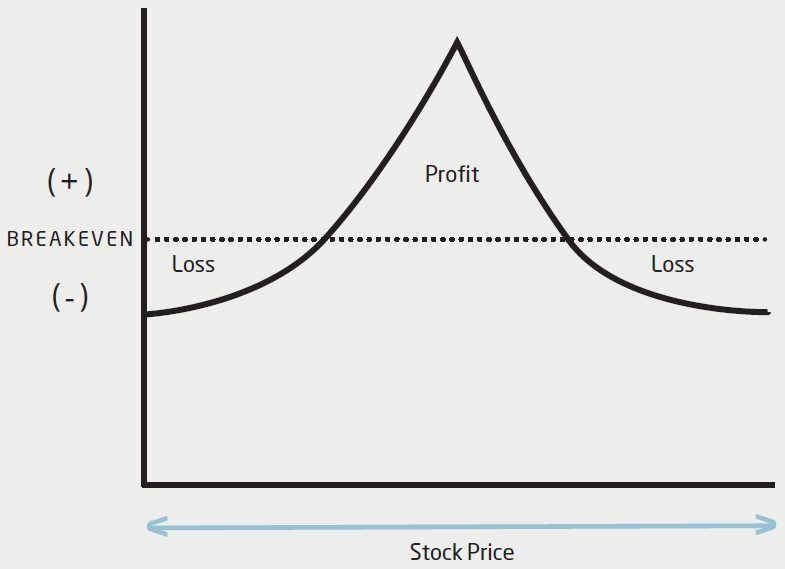

Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. Web a long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration. Web a long calendar spread, which is.

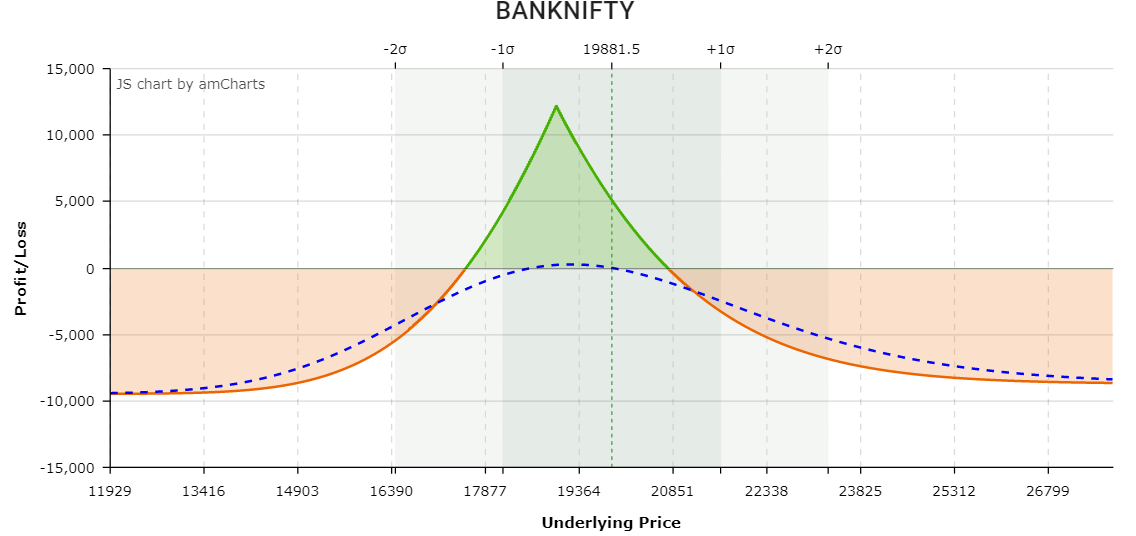

Long Calendar Spreads Unofficed

Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web the objective for a long call calendar.

The Long Calendar Spread Explained 1 Options Trading Software

The long calendar spread and the short calendar. A long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web what is a long calendar spread? Web a.

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term. Web a calendar.

Options Cafe Blog Education 1 Options Trading Software

Web a long calendar spread, which is also referred to as time spread or horizontal spread, is a trading strategy for. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A long calendar spread is a long option and a short option of.

Long Calendar Spreads Unofficed

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web this article will focus on the two most common forms of time spread: Web the long calendar option spread can be entered by purchasing one contract and simultaneously selling. Web updated october.

Long Calendar Spread with Puts Strategy With Example

A long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term. Web this article will focus.

Web what is a long calendar spread? A long calendar spread consists of two options of the same type and strike price, but with different expirations. The long calendar spread and the short calendar. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to those who. Web long calendar spreads with puts are frequently compared to short straddles and short strangles, because all three. Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web a long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration. Web this article will focus on the two most common forms of time spread: Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A long calendar spread is a long option and a short option of the same type and strike but with less dte (days to expiration). Web a calendar spread is a strategy used in options and futures trading: Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term. Web a calendar spread is a time spread. Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. Web the long calendar option spread can be entered by purchasing one contract and simultaneously selling. Web a long calendar spread, which is also referred to as time spread or horizontal spread, is a trading strategy for. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread.

Web Long Calendar Spreads With Puts Are Frequently Compared To Short Straddles And Short Strangles, Because All Three.

A long calendar spread consists of two options of the same type and strike price, but with different expirations. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web you’d then be long a june/july calendar spread for a $1 debit plus transaction costs, which is also your. Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best.

A Long Calendar Spread Is A Long Option And A Short Option Of The Same Type And Strike But With Less Dte (Days To Expiration).

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web the long calendar option spread can be entered by purchasing one contract and simultaneously selling. Web a long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

Web A Calendar Spread Is A Time Spread.

Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to profit in ways not available to those who. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in. Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike.

Web A Long Calendar Spread, Which Is Also Referred To As Time Spread Or Horizontal Spread, Is A Trading Strategy For.

It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web what is a long calendar spread? Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term. Web this article will focus on the two most common forms of time spread: