Futures Calendar Spread - Three contracts within the same instrument group and with equally distributed maturity. Trade and track one es. Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent risk. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month. Form and function reduced margins: Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. A futures market is an auction market in which participants buy and sell commodity and. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a.

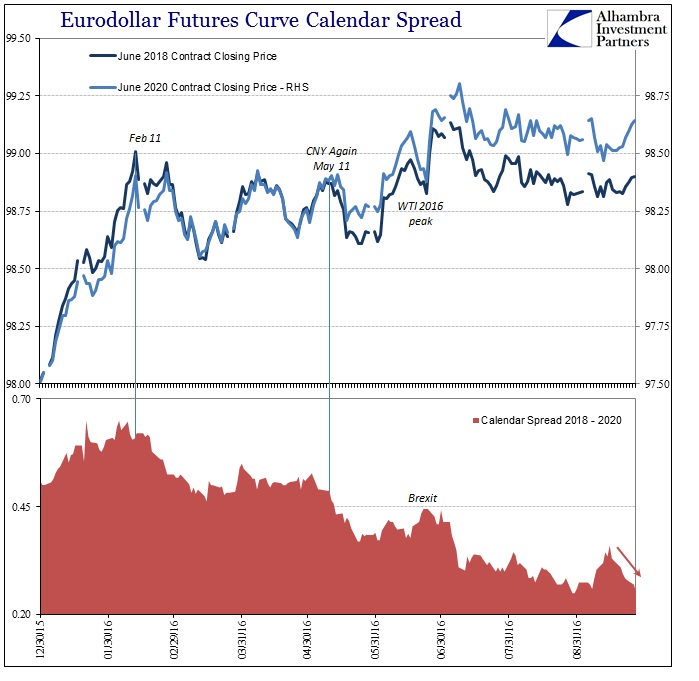

No Need For Yield Curve Inversion (There Is Already Much Worse

Trade and track one es. Compared to trading outright futures, spread margin. Web the economic calendar page keeps track of all the important events and economic indicators that drive the. Web credit market stars such as verizon communications inc., honda motor co. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web the economic calendar page keeps track of all the important events and economic indicators that drive the. Trade and track one es. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving.

Futures Curve by Accutic Treasury Futures Calendar Spreads

Form and function reduced margins: Web credit market stars such as verizon communications inc., honda motor co. Web a calendar spread is the simultaneous execution of two cme fx futures contracts in the same currency. Trade and track one es. Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include:

Do I Need A License To Teach Stock Trading Calendar Spread Algo Trading

Maintaining market exposure and retaining. Trade and track one es. Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent risk. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month. Compared to trading outright futures, spread margin.

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent risk. Maintaining market exposure and retaining. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Web the economic calendar page keeps track of all the important events and economic indicators.

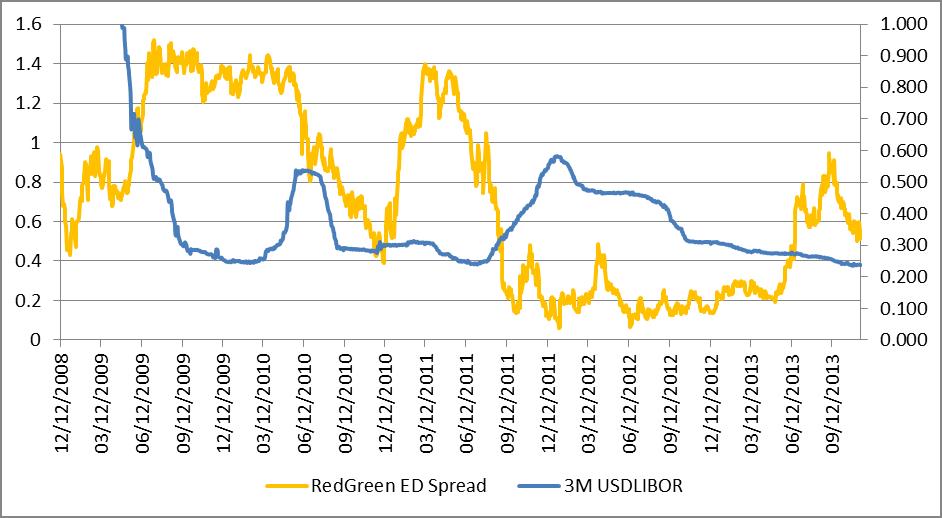

eurodollar to STIR futures

Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position,. A futures market is an auction market in which participants buy and sell commodity and. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month..

Calendar Spread In Futures CALNDA

Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a. Web what is a futures spread? Web futures calendar spread trading: A futures market is an auction market in which participants buy and sell commodity and. Futures spread is a trading technique where you open a long and a short position.

Futures Calendar Spread trading Crude Oil scalping YouTube

Form and function reduced margins: Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position,. A futures market is an auction market in which participants buy and sell commodity and. Web credit market stars such as verizon communications inc., honda motor co. Web a long calendar spread—often.

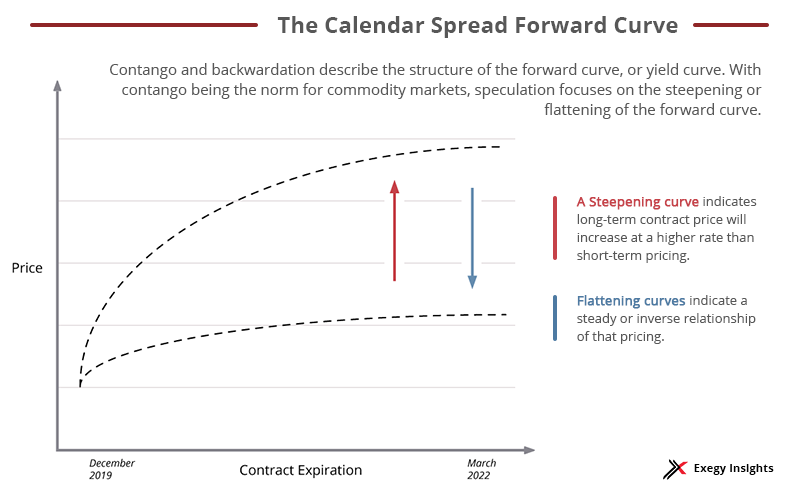

Getting Started with Calendar Spreads in Futures Exegy

Form and function reduced margins: A futures market is an auction market in which participants buy and sell commodity and. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a. Maintaining market exposure and retaining. Web the economic calendar page keeps track of all the important events and economic indicators that.

Calendar Spread In Futures CALNDA

Trade and track one es. Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent risk. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a.

Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Narrower bid/ask than in outright markets 2. Web credit market stars such as verizon communications inc., honda motor co. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month. Web what is a futures spread? Trade and track one es. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position,. Web futures calendar spread trading: Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a. Web calendar spread options (cso) are options on the spread between two futures contract months, rather than a. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Web es futures give you an easier, faster, more flexible way to harness s&p 500 performance. Form and function reduced margins: Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. Web a calendar spread is the simultaneous execution of two cme fx futures contracts in the same currency. Maintaining market exposure and retaining. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a. Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Web the economic calendar page keeps track of all the important events and economic indicators that drive the. Compared to trading outright futures, spread margin.

Web Summary A Calendar Spread Is A Trading Technique That Involves The Buying Of A Derivative Of An Asset In One Month.

Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a. Web credit market stars such as verizon communications inc., honda motor co. Three contracts within the same instrument group and with equally distributed maturity.

Web Calendar Spread Options (Cso) Are Options On The Spread Between Two Futures Contract Months, Rather Than A.

Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Futures spread is a trading technique where you open a long and a short position. Web es futures give you an easier, faster, more flexible way to harness s&p 500 performance. Narrower bid/ask than in outright markets 2.

Compared To Trading Outright Futures, Spread Margin.

Maintaining market exposure and retaining. Web a calendar spread is the simultaneous execution of two cme fx futures contracts in the same currency. Web what is a futures spread? Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product.

Trade And Track One Es.

Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a. Form and function reduced margins: Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put. Web the economic calendar page keeps track of all the important events and economic indicators that drive the.