Double Calendar Spread - A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Web the structure for both double calendars and double diagonals thus consists of four different, two long and two. It involves opening two positions on the same underlying with different strike prices and expiration dates, each of which has a call and a put option. Web what is a calendar spread? Learn how to build, trade and manage this strategy with examples and tips. It allows your options to deteriorate a lot quicker at picking up your premium or making more on the premium. Market timing is much less critical when trading spreads, but. The strategy aims to profit from the underlying price action around two different strike prices, with a wider breakeven range and a higher probability of making a profit. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Pricing our revolutionary low rates make for easier.

Double Calendar Spreads Ultimate Guide With Examples

Understand when it may be better to set up a double calendar spread. The stock market double calendar spread strategy is a very safe options trading. The strategy aims to profit from the underlying price action around two different strike prices, with a wider breakeven range and a higher probability of making a profit. Learn how theta and vega can.

double calendar spread Options Trading IQ

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Web the double calendar spread is essentially two calendar spreads. Web open an account stocks / options / futures / you deserve a better broker. Web the structure for both double calendars and double diagonals thus consists.

Pin on CALENDAR SPREADS OPTIONS

It allows your options to deteriorate a lot quicker at picking up your premium or making more on the premium. Pricing our revolutionary low rates make for easier. Learn how theta and vega can give your calendar and double calendar spread a boost. Web explore our expanded education library. Web the double calendar spread and the double diagonal spread are.

Double Calendar Spreads Ultimate Guide With Examples

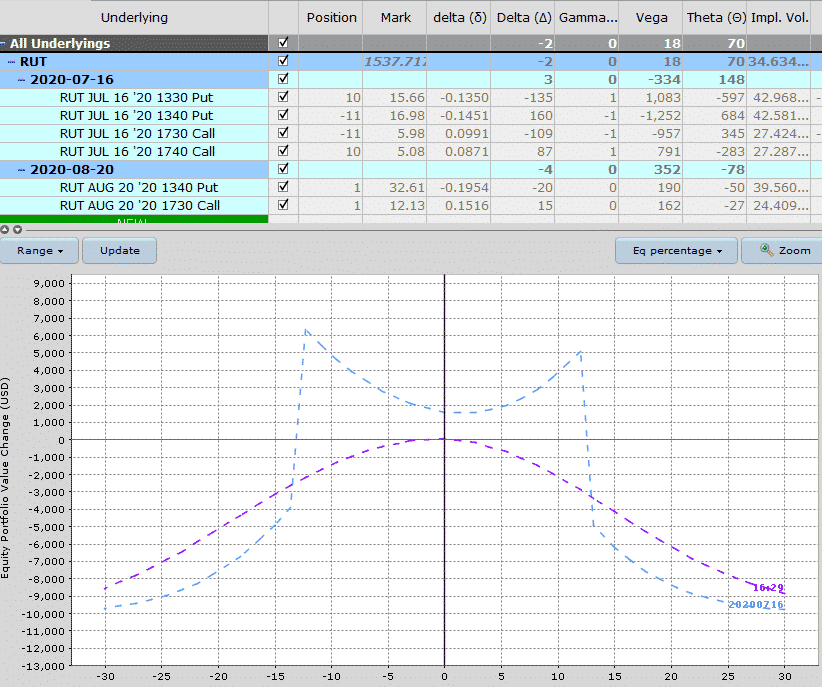

It involves opening two positions on the same underlying with different strike prices and expiration dates, each of which has a call and a put option. Web for some option traders, double calendar spreads are one substitute strategy to consider for iron condors. Web what is a calendar spread? Web for example, if i opened the 145 calendar spread with.

Double Calendar Spreads Ultimate Guide With Examples

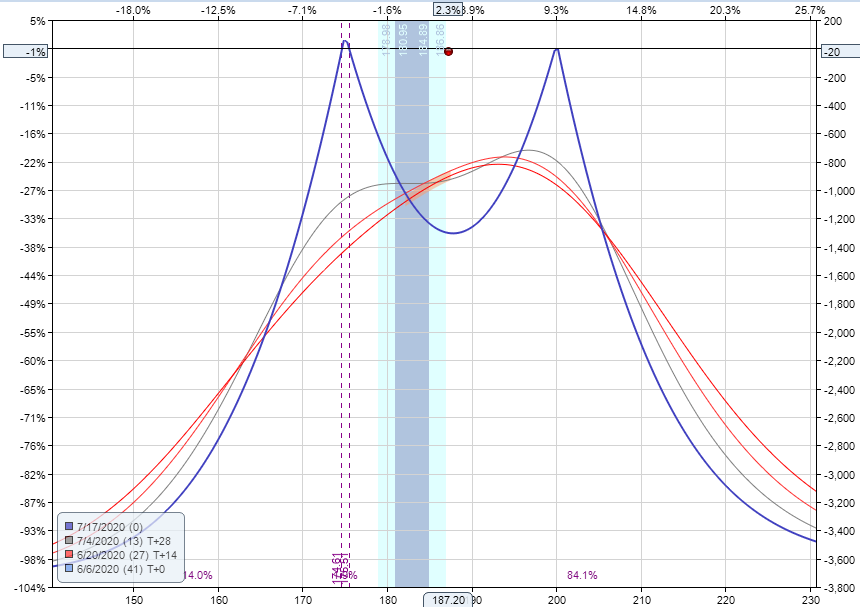

And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread that allows for a quick response to changing market conditions. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. It allows your options to deteriorate a lot quicker.

Pin on CALENDAR SPREADS OPTIONS

Web for example, if i opened the 145 calendar spread with the stock at 145, and the stock moved to 146, i might open the 147 calendar. Market timing is much less critical when trading spreads, but. It involves opening two positions on the same underlying with different strike prices and expiration dates, each of which has a call and.

Double Calendar Spreads Ultimate Guide With Examples

Understand when it may be better to set up a double calendar spread. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web the double calendar spread is essentially two calendar spreads. Web what is a calendar spread? Web 48k views 6 years ago.

Pin on CALENDAR SPREADS OPTIONS

It allows your options to deteriorate a lot quicker at picking up your premium or making more on the premium. Examples below of how to trade dcs in practice double calendar spreads are a short vol play and. The stock market double calendar spread strategy is a very safe options trading. Web the double calendar spread is essentially two calendar.

Double Calendar Spreads Ultimate Guide With Examples

The stock market double calendar spread strategy is a very safe options trading. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web the double calendar spread! The strategy aims to profit from the underlying price action around two different strike prices, with a wider.

Pin on CALENDAR SPREADS OPTIONS

Web what is a calendar spread? Web 48k views 6 years ago. Learn how to build, trade and manage this strategy with examples and tips. Examples below of how to trade dcs in practice double calendar spreads are a short vol play and. Web as the name suggests, a double calendar spread is created by using two calendar spreads.

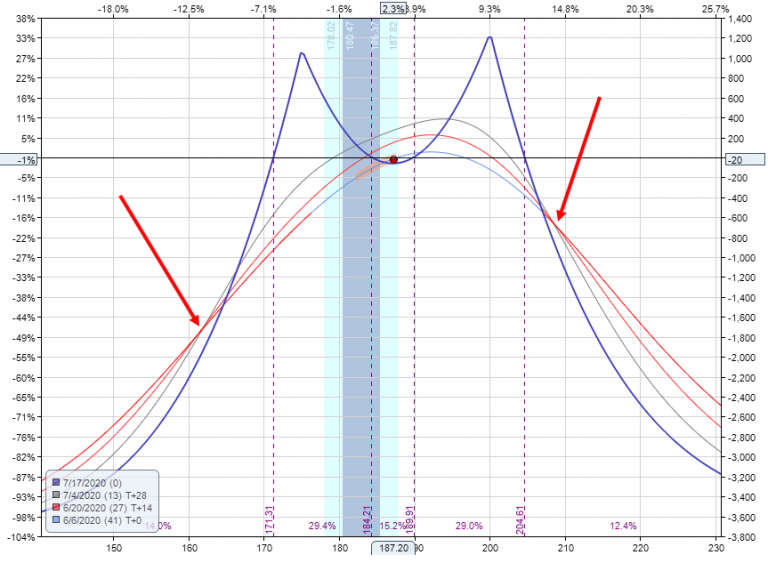

Examples below of how to trade dcs in practice double calendar spreads are a short vol play and. Web the structure for both double calendars and double diagonals thus consists of four different, two long and two. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Web a double calendar spread is a trading strategy that exploits time differences in the volatility of an underlying asset. It involves opening two positions on the same underlying with different strike prices and expiration dates, each of which has a call and a put option. Web the last risk to avoid when trading calendar spreads is an untimely entry. I try to set up my double calendars with about a 70%. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Web what is a calendar spread? Web explore our expanded education library. And with weekly options (not monthly expiration) comes the additional opportunity to design a double calendar spread that allows for a quick response to changing market conditions. The strategy aims to profit from the underlying price action around two different strike prices, with a wider breakeven range and a higher probability of making a profit. It involves selling near expiry calls and puts and buying further. Understand when it may be better to set up a double calendar spread. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. It allows your options to deteriorate a lot quicker at picking up your premium or making more on the premium. Web for example, if i opened the 145 calendar spread with the stock at 145, and the stock moved to 146, i might open the 147 calendar. Learn how to build, trade and manage this strategy with examples and tips. Web open an account stocks / options / futures / you deserve a better broker. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long.

And With Weekly Options (Not Monthly Expiration) Comes The Additional Opportunity To Design A Double Calendar Spread That Allows For A Quick Response To Changing Market Conditions.

Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. I try to set up my double calendars with about a 70%. Pricing our revolutionary low rates make for easier. Web 48k views 6 years ago.

Web A Double Calendar Spread Is A Trading Strategy That Exploits Time Differences In The Volatility Of An Underlying Asset.

The strategy aims to profit from the underlying price action around two different strike prices, with a wider breakeven range and a higher probability of making a profit. Learn how theta and vega can give your calendar and double calendar spread a boost. Web the last risk to avoid when trading calendar spreads is an untimely entry. Understand when it may be better to set up a double calendar spread.

Web What Is A Calendar Spread?

Market timing is much less critical when trading spreads, but. Web the double calendar spread is essentially two calendar spreads. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the.

Web Explore Our Expanded Education Library.

Web as the name suggests, a double calendar spread is created by using two calendar spreads. Web the double calendar spread! The stock market double calendar spread strategy is a very safe options trading. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long.