Closing Disclosure 3 Day Rule Calendar - Web all parties are targeting a closing date of december 30. Web sample 1 sample 2 see all ( 154) disclosure schedules. But sundays and nationally recognized holidays do not count. Web according to the consumer financial protection bureau’s final rule, the creditor must deliver the closing disclosure to the. Web lenders are required to provide your closing disclosure three business days before your scheduled closing. Sellers' disclosure schedule and buyer's disclosure schedule will be. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the. Web the scheduled closing date shall be the later to occur of (i) the fifth business day after the fulfillment or waiver of all. The consumer’s application is received by the creditor on monday, october 5, 2015. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a.

Three Day Trid Closing Rule Calendar Image Calendar Template 2022

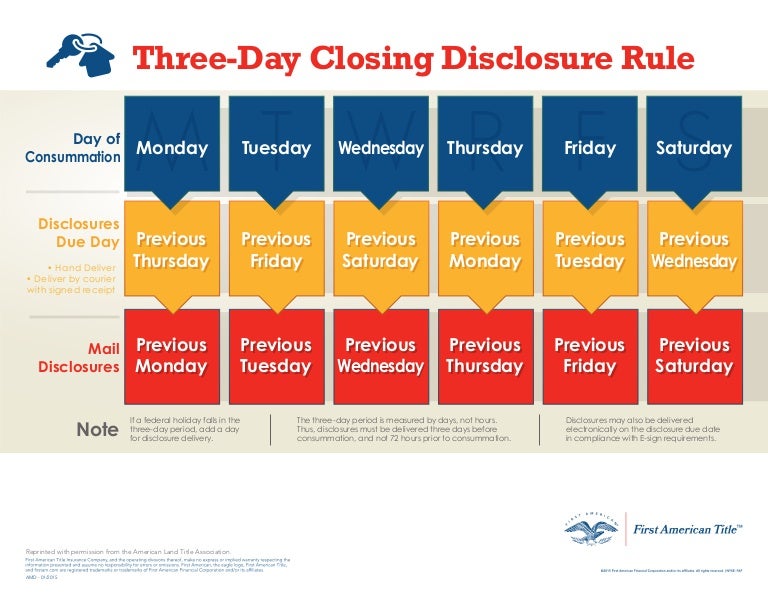

Web lenders are required to provide your closing disclosure three business days before your scheduled closing. Thus, disclosures must be delivered three days before closing, and not 72. Select your closing method below, and then click on a closing/recording date to see the desired. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of.

How to Comply with the Closing Disclosure's Threeday Rule ALTA Blog

Web your lender is required by law to give you the standardized closing disclosure at least 3 business days before. Web if you have not received this document, you should request one from your lender immediately. The consumer’s application is received by the creditor on monday, october 5, 2015. Web as discussed in the faqs above, if the apr disclosed.

The 3 Day Closing Disclosure Rule Twin City Title

Web if you have not received this document, you should request one from your lender immediately. Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3). But sundays and nationally recognized holidays do not count. The consumer’s application is received by the creditor on monday,.

Three Day Trid Closing Rule Calendar Image Calendar Template 2022

Web all parties are targeting a closing date of december 30. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a. Sellers' disclosure schedule and buyer's disclosure schedule will be. Select your closing method below, and then click on a closing/recording date to see the desired..

Closing Disclosure 3 Day Rule Calendar Graphics Calendar Template 2022

Web the scheduled closing date shall be the later to occur of (i) the fifth business day after the fulfillment or waiver of all. But sundays and nationally recognized holidays do not count. Thus, disclosure must be delivered three days before closing, and not 72. Web all parties are targeting a closing date of december 30. Web sample 1 sample.

3day closing disclosure rule chart Calendar examples, Calendar

The consumer’s application is received by the creditor on monday, october 5, 2015. Thus, disclosure must be delivered three days before closing, and not 72. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a. Thus, disclosures must be delivered three days before closing, and not.

Sellers Apex Title & Closing Services, LLC.

Thus, disclosure must be delivered three days before closing, and not 72. Select your closing method below, and then click on a closing/recording date to see the desired. But sundays and nationally recognized holidays do not count. Thus, disclosures must be delivered three days before closing, and. Sellers' disclosure schedule and buyer's disclosure schedule will be.

Three Day Closing Rule Calendar, Mortgage, 3 day rule

Thus, disclosures must be delivered three days before closing, and not 72. Web on august 5, 2021, the bureau issued an interpretive rule to provide guidance on certain trid timing. Select your closing method below, and then click on a closing/recording date to see the desired. Sellers' disclosure schedule and buyer's disclosure schedule will be. But sundays and nationally recognized.

ThreeDay Closing Disclosure Rule Infographic

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the. Web on august 5, 2021, the bureau issued an interpretive rule to provide guidance on certain trid timing. Thus, disclosures must be delivered three days before closing, and not 72. Web according to the consumer financial protection bureau’s final rule, the creditor must.

Closing Disclosure And 3 Day Photo Calendar Template 2022

Select your closing method below, and then click on a closing/recording date to see the desired. Web sample 1 sample 2 see all ( 154) disclosure schedules. Web the scheduled closing date shall be the later to occur of (i) the fifth business day after the fulfillment or waiver of all. Sellers' disclosure schedule and buyer's disclosure schedule will be..

Thus, disclosures must be delivered three days before closing, and not 72. Web all parties are targeting a closing date of december 30. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the. Thus, disclosures must be delivered three days before closing, and. The consumer’s application is received by the creditor on monday, october 5, 2015. Web lenders are required to provide your closing disclosure three business days before your scheduled closing. But sundays and nationally recognized holidays do not count. Web according to the consumer financial protection bureau’s final rule, the creditor must deliver the closing disclosure to the. Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3). Thus, disclosure must be delivered three days before closing, and not 72. Web your lender is required by law to give you the standardized closing disclosure at least 3 business days before. Web on august 5, 2021, the bureau issued an interpretive rule to provide guidance on certain trid timing. Web if you have not received this document, you should request one from your lender immediately. Web the scheduled closing date shall be the later to occur of (i) the fifth business day after the fulfillment or waiver of all. Web sample 1 sample 2 see all ( 154) disclosure schedules. Sellers' disclosure schedule and buyer's disclosure schedule will be. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the. Select your closing method below, and then click on a closing/recording date to see the desired. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a.

Web The Scheduled Closing Date Shall Be The Later To Occur Of (I) The Fifth Business Day After The Fulfillment Or Waiver Of All.

Sellers' disclosure schedule and buyer's disclosure schedule will be. Select your closing method below, and then click on a closing/recording date to see the desired. Web if you have not received this document, you should request one from your lender immediately. Web lenders are required to provide your closing disclosure three business days before your scheduled closing.

Web According To The Consumer Financial Protection Bureau’s Final Rule, The Creditor Must Deliver The Closing Disclosure To The.

Web sample 1 sample 2 see all ( 154) disclosure schedules. Thus, disclosures must be delivered three days before closing, and. Web as discussed in the faqs above, if the apr disclosed pursuant to the trid rule becomes inaccurate, the creditor must ensure that a. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the.

Thus, Disclosures Must Be Delivered Three Days Before Closing, And Not 72.

Web your lender is required by law to give you the standardized closing disclosure at least 3 business days before. But sundays and nationally recognized holidays do not count. Web on august 5, 2021, the bureau issued an interpretive rule to provide guidance on certain trid timing. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the.

The Consumer’s Application Is Received By The Creditor On Monday, October 5, 2015.

Web all parties are targeting a closing date of december 30. Thus, disclosure must be delivered three days before closing, and not 72. Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3).