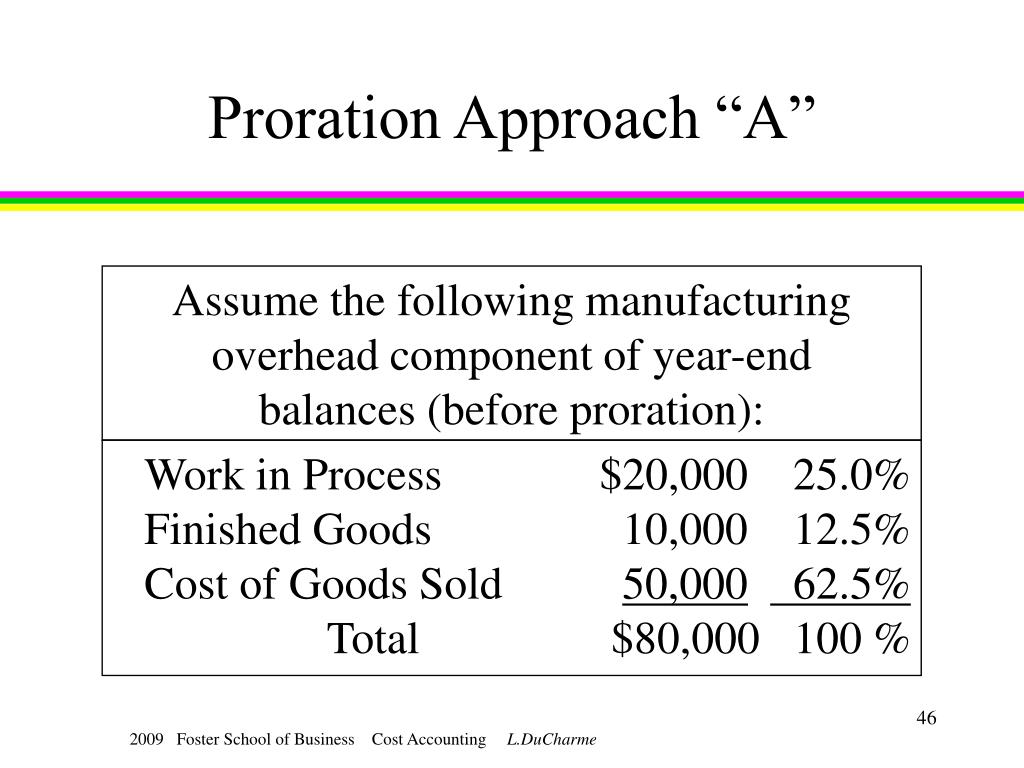

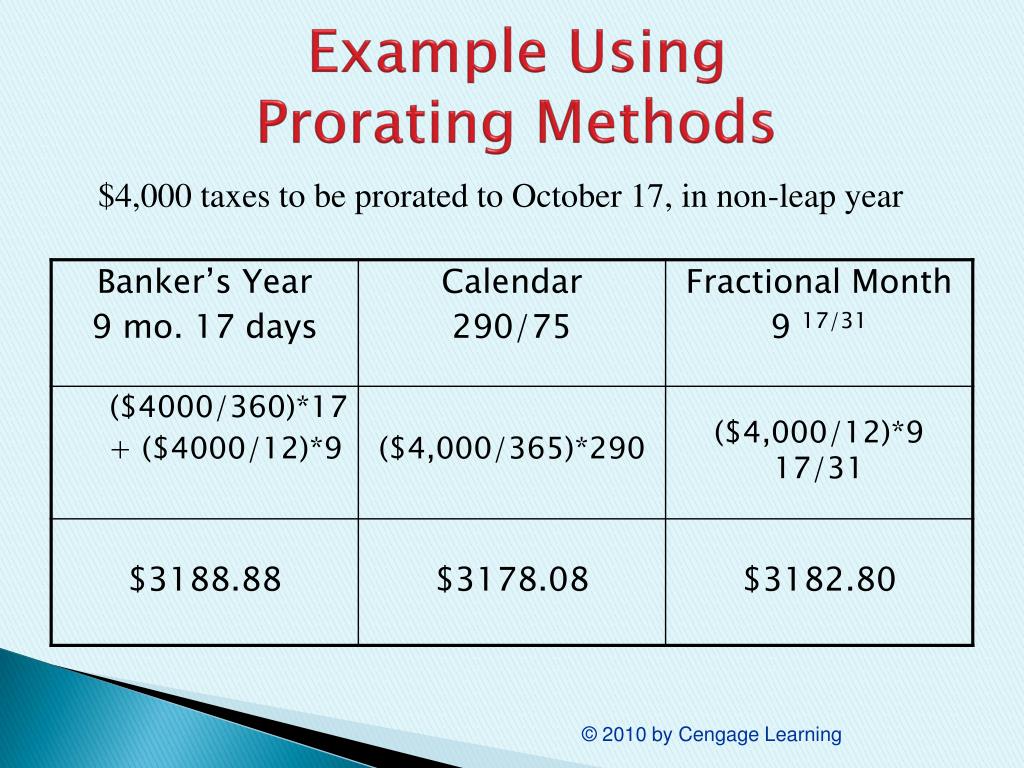

Calendar Year Proration Method - The steps in the calculation are the same. This calculator is designed to estimate the real estate tax proration. Web sue is selling her house for $265,000. Web calendar year of proration means the calendar year in which the closing occurs. Proration for the month and year in which this agreement becomes effective or terminates, there. Web proration is the allocation or dividing of certain money items at the closing. Web four methods for pro rating rent are actual days in the month, average days in the month, banker’s month, and days in the calendar year. Web prs is a calendar year partnership that uses the interim closing method and monthly convention to account for variations during. Amount of pro rated rent varies based on the number of days in the month and the proration method used. Web to divide or distribute proportionately. (the american college dictionary, page 972, 1960) buyers and sellers can agree to prorate taxes in any way they'd.

Depreciation Calculation for Table and Calculated Methods (Oracle

Web four methods for pro rating rent are actual days in the month, average days in the month, banker’s month, and days in the calendar year. Web sue is selling her house for $265,000. Web there are two basic proration types used in residential real estate transactions. When using the previous calendar year’s taxes to prorate, the taxes are calculated.

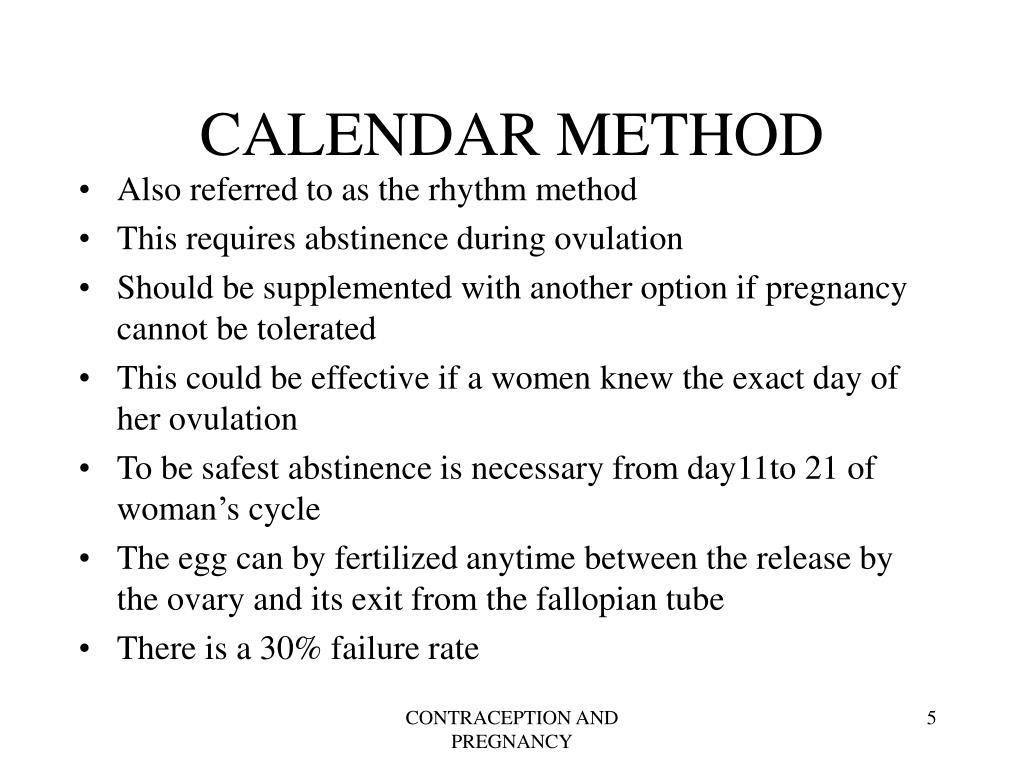

What are the different types of contraception? Medicszone

Web the foregoing information is confidential and proprietary to realpage, inc., and is intended solely for its customer’s business use. Closing is set for june 19, and sue owns the day of closing. Web prorate a specified amount over a specified portion of the calendar year. In this scenario, the account. These two types of proration methods are referred to.

PPT Contraception PowerPoint Presentation, free download ID6573279

Web the foregoing information is confidential and proprietary to realpage, inc., and is intended solely for its customer’s business use. The formula is as follows: This option is very simple, but it may not accurately reflect economic reality. Amount of pro rated rent varies based on the number of days in the month and the proration method used. Web to.

Checking what Months are during a Project — Smartsheet Community

Web prs is a calendar year partnership that uses the interim closing method and monthly convention to account for variations during. “closing” shall mean the consummation of. Web to divide or distribute proportionately. (the american college dictionary, page 972, 1960) buyers and sellers can agree to prorate taxes in any way they'd. With a may 28 closing date. An attorney,.

Calendar Month Rental Calculator Calendar printables, Printable

An attorney, a real estate salesperson, or a broker does the proration. Amount of pro rated rent varies based on the number of days in the month and the proration method used. Web there are two basic proration types used in residential real estate transactions. Web proration is the allocation or dividing of certain money items at the closing. (number.

SSA POMS DI 52170.055 Calendars for Proration (19642028) 09/25/2008

Web 365 days in a year. Web property tax proration calculator. When using the previous calendar year’s taxes to prorate, the taxes are calculated based on the total. Web sue is selling her house for $265,000. The steps in the calculation are the same.

PPT Job Order Costing PowerPoint Presentation, free download ID3338100

This calculator is designed to estimate the real estate tax proration. The type of proration used in a transaction is predicated by the purchase contract provision regarding real estate taxes. Under the proration method, the departing. Web to divide or distribute proportionately. (the american college dictionary, page 972, 1960) buyers and sellers can agree to prorate taxes in any way.

Should You Have Sex Twice on Ovulation Day? ConceiveEasy

Proration for the month and year in which this agreement becomes effective or terminates, there. Closing is set for june 19, and sue owns the day of closing. Web prorate a specified amount over a specified portion of the calendar year. The formula is as follows: Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the.

PPT CONTRACEPTION AND PLANNING FOR PREGNANCY PowerPoint Presentation

Web example 1 the annual amount of a billing schedule is 5000.00. The formula is as follows: Web proration is the allocation or dividing of certain money items at the closing. An attorney, a real estate salesperson, or a broker does the proration. Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties.

PPT Chapter 16 ________________ Title Closing and Escrow PowerPoint

Web prorate a specified amount over a specified portion of the calendar year. These two types of proration methods are referred to as long proration and short proration. Closing is set for june 19, and sue owns the day of closing. Web 365 days in a year. Web related to date of proration.

This option is very simple, but it may not accurately reflect economic reality. The formula is as follows: (number of days occupied / 365 days in a year) x (monthly rental amount x 12 months in a year) a $1,000 per month lease beginning may 15, 2019 produces the following: The type of proration used in a transaction is predicated by the purchase contract provision regarding real estate taxes. Proration is inclusive of both specified dates. These two types of proration methods are referred to as long proration and short proration. Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties. Closing is set for june 19, and sue owns the day of closing. Web prs is a calendar year partnership that uses the interim closing method and monthly convention to account for variations during. Web sue is selling her house for $265,000. With a may 28 closing date. Under the proration method, the departing. Web prorate a specified amount over a specified portion of the calendar year. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at. “closing” shall mean the consummation of. Web property tax proration calculator. Web related to date of proration. This calculator is designed to estimate the real estate tax proration. Web there are two basic proration types used in residential real estate transactions. In this scenario, the account.

Web Property Tax Proration Calculator.

This calculator is designed to estimate the real estate tax proration. Web there are two basic proration types used in residential real estate transactions. Web 365 days in a year. The steps in the calculation are the same.

Web Prorate A Specified Amount Over A Specified Portion Of The Calendar Year.

These two types of proration methods are referred to as long proration and short proration. Taxes and assessments, insurance, assumed interest, rents, and other expenses and revenue of the properties. Closing is set for june 19, and sue owns the day of closing. Amount of pro rated rent varies based on the number of days in the month and the proration method used.

Web Assuming The Buyer Owns The Property On Closing Day, And The Seller Hasn't Made Any Payments, What Will The Seller Owe At.

In this scenario, the account. Proration for the month and year in which this agreement becomes effective or terminates, there. Under the proration method, the departing. The start date is august 12, 2019;

An Attorney, A Real Estate Salesperson, Or A Broker Does The Proration.

(number of days occupied / 365 days in a year) x (monthly rental amount x 12 months in a year) a $1,000 per month lease beginning may 15, 2019 produces the following: Web to divide or distribute proportionately. (the american college dictionary, page 972, 1960) buyers and sellers can agree to prorate taxes in any way they'd. Web the foregoing information is confidential and proprietary to realpage, inc., and is intended solely for its customer’s business use. Proration is inclusive of both specified dates.