Calendar Spread Futures - Form and function reduced margins: Web a calendar spread is a strategy used in options and futures trading: Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web futures spread is a trading technique where you open a long and a short position simultaneously to take advantage. Web answer (1 of 3): Web by srinivasan sivabalan. Web position, one would buy the calendar spread. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

For example, you create a near. Web position, one would buy the calendar spread. Compared to trading outright futures, spread margin. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. For example, steve the investor.

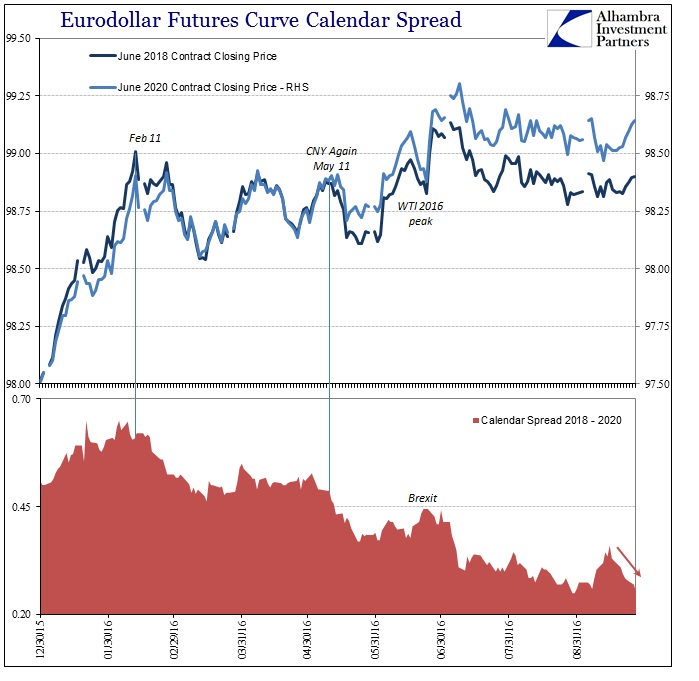

Futures Markets US Dollar reserve currency status Ticker Tape

Web one such strategy is known as the calendar spread, sometimes referred to as a time spread. when entered using. Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the.

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

Compared to trading outright futures, spread margin. For example, steve the investor. Web futures spread is a trading technique where you open a long and a short position simultaneously to take advantage. Web the most common type of spread utilized for futures is a calendar strategy. Web calendar spread options provide a leveraged means of hedging against or capitalizing on.

No Need For Yield Curve Inversion (There Is Already Much Worse

Web calendar spreads are most often used when trading options and futures contracts. The difference between the futures contracts of the same commodity. Web the most common type of spread utilized for futures is a calendar strategy. Web what is a calendar spread? Compared to trading outright futures, spread margin.

CALENDARSPREAD Simpler Trading

It is beneficial only when a day trader expects the derivative to have a. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a. Web calendar spreads in futures calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration. Web in finance, a calendar.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

Web options and futures traders mostly use the calendar spread. Compared to trading outright futures, spread margin. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web answer (1 of 3): The benefits of utilizing treasury futures calendar spreads on the cme globex electronic.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

Web futures spread is a trading technique where you open a long and a short position simultaneously to take advantage. Web calendar spreads are strategies utilized in options and futures trading. Web i had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. The difference between the futures contracts of the same commodity. A.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web position, one would buy the calendar spread. Using this strategy, two positions. The benefits of utilizing treasury futures calendar spreads on the cme globex electronic. Web answer (1 of 3): From the “all products” screen on the trade page, enter a future in the symbol entry field 2.

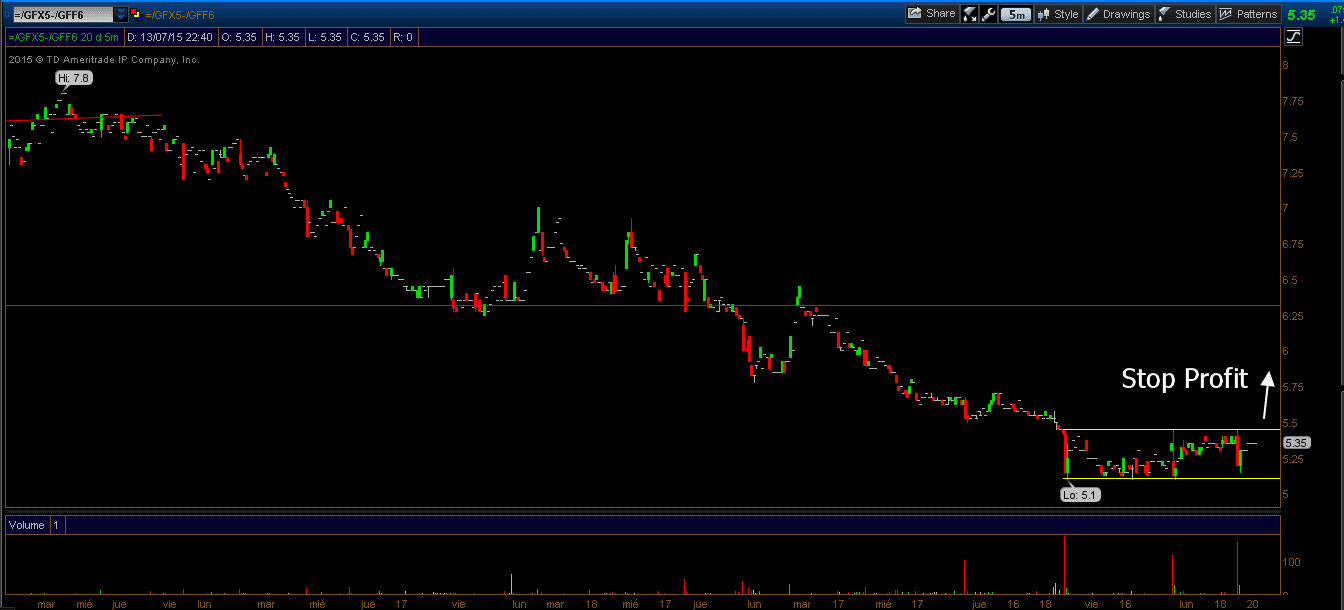

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. Web learn about spreading.

NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

It is beneficial only when a day trader expects the derivative to have a. The benefits of utilizing treasury futures calendar spreads on the cme globex electronic. Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. Web by srinivasan sivabalan. From the “all products” screen on the trade page, enter a future in.

Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. The current odds for north carolina to earn a berth in the college football playoff are +2200 and the tar. Web calendar spreads are strategies utilized in options and futures trading. It is beneficial only when a day trader expects the derivative to have a. Web position, one would buy the calendar spread. Web what is a calendar spread? The difference between the futures contracts of the same commodity. Web calendar spreads in futures calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration. A calendar spread is where a trader simultaneously sells a future at a near month expiry date and buys a future at a. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web the most common type of spread utilized for futures is a calendar strategy. Compared to trading outright futures, spread margin. For example, steve the investor. Web options and futures traders mostly use the calendar spread. Web calendar spreads are most often used when trading options and futures contracts. Using this strategy, two positions. Web by srinivasan sivabalan. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web a calendar spread is a strategy used in options and futures trading: Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different.

Web In Finance, A Calendar Spread (Also Called A Time Spread Or Horizontal Spread) Is A Spread Trade Involving The Simultaneous Purchase.

From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web by srinivasan sivabalan. Web one such strategy is known as the calendar spread, sometimes referred to as a time spread. when entered using. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different.

Web Futures Spread Is A Trading Technique Where You Open A Long And A Short Position Simultaneously To Take Advantage.

Form and function reduced margins: Web futures calendar spread trading: For example, you create a near. The benefits of utilizing treasury futures calendar spreads on the cme globex electronic.

August 17, 2023 At 2:23 Am Pdt.

Compared to trading outright futures, spread margin. For example, steve the investor. The difference between the futures contracts of the same commodity. Web what is a calendar spread?

Web I Had Briefly Introduced The Concept Of Calendar Spreads In Chapter 10 Of The Futures Trading Module.

Web options and futures traders mostly use the calendar spread. Web position, one would buy the calendar spread. Web calendar spreads are most often used when trading options and futures contracts. A calendar spread is where a trader simultaneously sells a future at a near month expiry date and buys a future at a.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)