Calendar Put Spread - On the file menu, click new. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use. Web click the data tab. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while. The short calendar put spread is used to try and profit when you are expecting a security to. Web put calendar example; Bullet markets fixed income news homepage +4,000 usv3. Web wiktionary (0.00 / 0 votes) rate these synonyms:. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

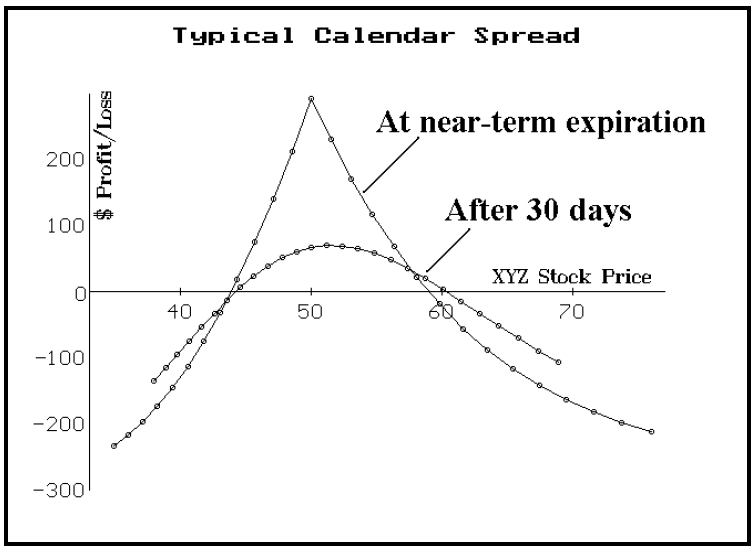

Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. Web a put calendar spread.

Options Trading Made Easy Ratio Put Calendar Spread

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in. The short calendar put spread is used to try and profit when you are expecting a security to. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

In the date and time format dialog box, in. Web put calendar example; Web to do this, click the start button ( office button), type mscomct2.ocx (or mscal.ocx in excel 2007 and earlier) in. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread..

Put Calendar Spread

In the data type box, click date and time (datetime). Web oct'23 30y put spread us tsy options. In the date and time format dialog box, in. Web what is a calendar spread? Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration.

Calendar Put Spread Options Edge

Web short calendar put spread. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use. The short calendar put spread is used to try and profit when you are expecting a security to. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call.

Long Calendar Spreads Unofficed

Put calendar spreads are neutral to bullish short. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different.

Bearish Put Calendar Spread Option Strategy Guide

Some traders might like to use another indicator to further confirm the trend. Web a calendar put spread is created when long term put options are bought and near term put options with the same strike price are. Web what is a calendar spread? It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear.

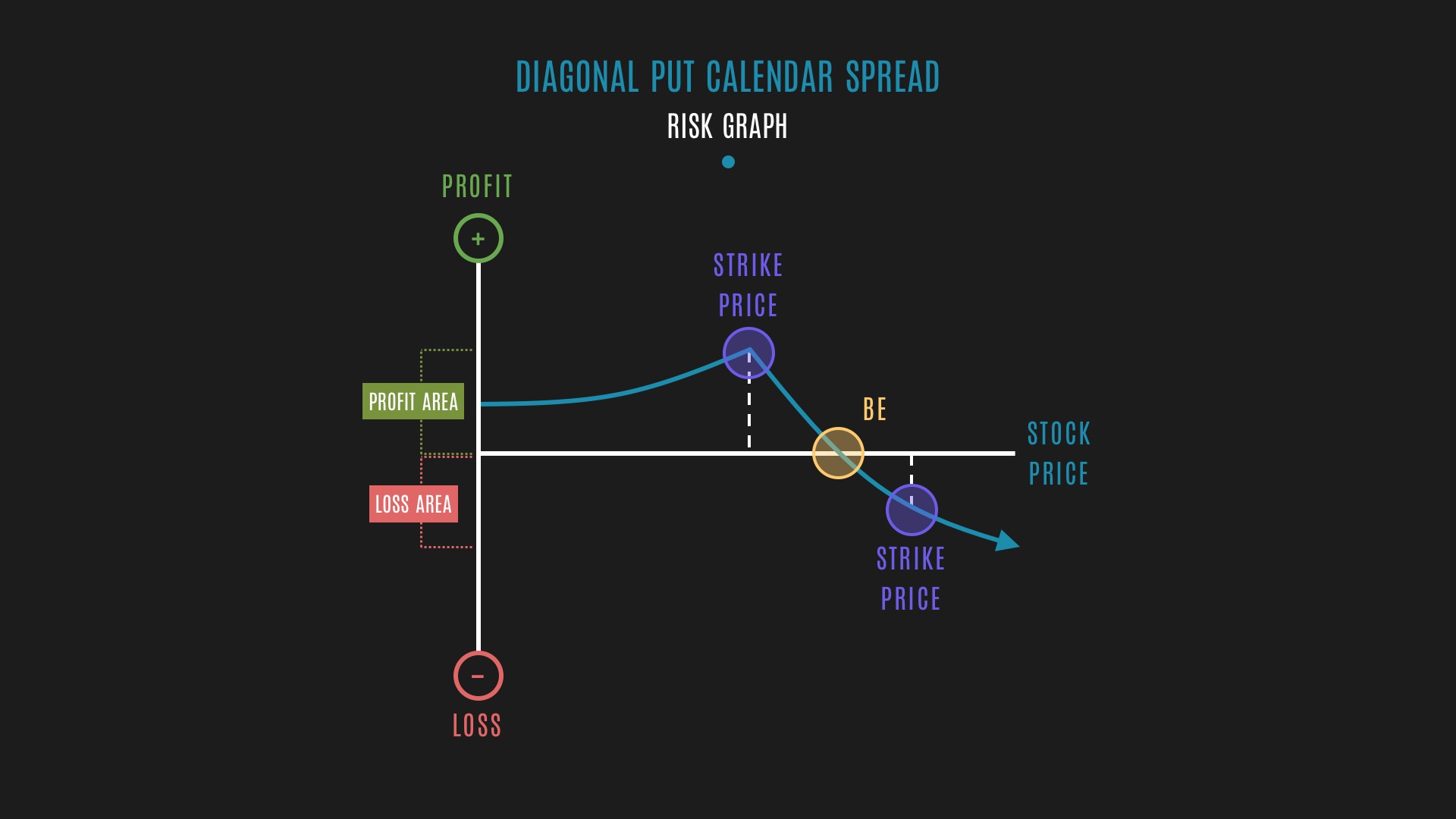

Glossary Diagonal Put Calendar Spread example Tackle Trading

To profit from a large stock price move away from the strike price of the. On the file menu, click new. Put calendar spreads are neutral to bullish short. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web short calendar put spread.

Pin on Option Trading Strategies

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in. Some traders might like to use another indicator to further confirm the trend. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the. In the date and.

Glossary Archive Tackle Trading

Bullet markets fixed income news homepage +4,000 usv3. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web to do this, click the start button ( office button), type mscomct2.ocx (or mscal.ocx in excel 2007 and earlier) in. Web entering into a calendar.

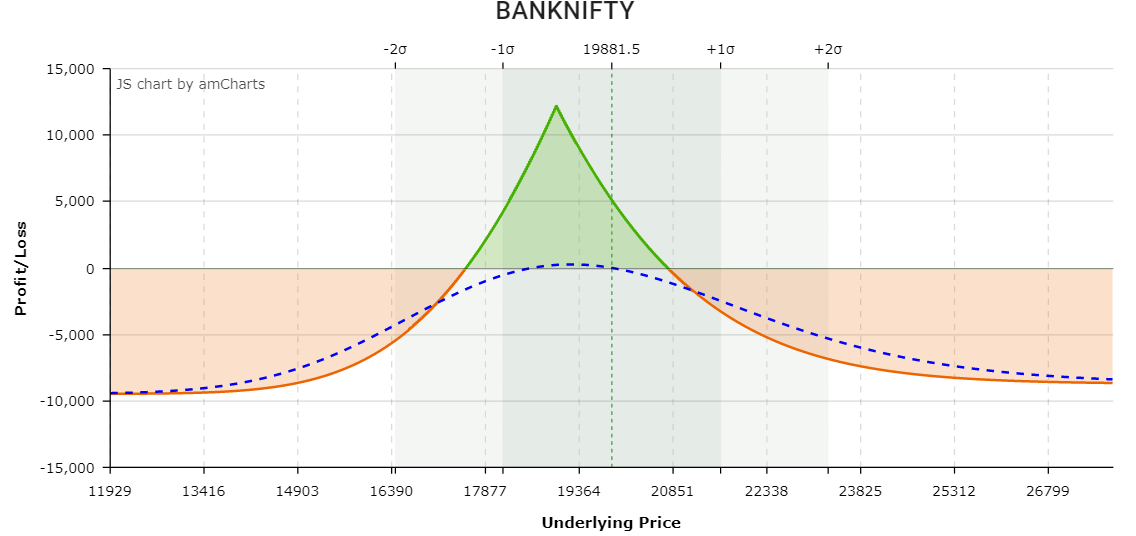

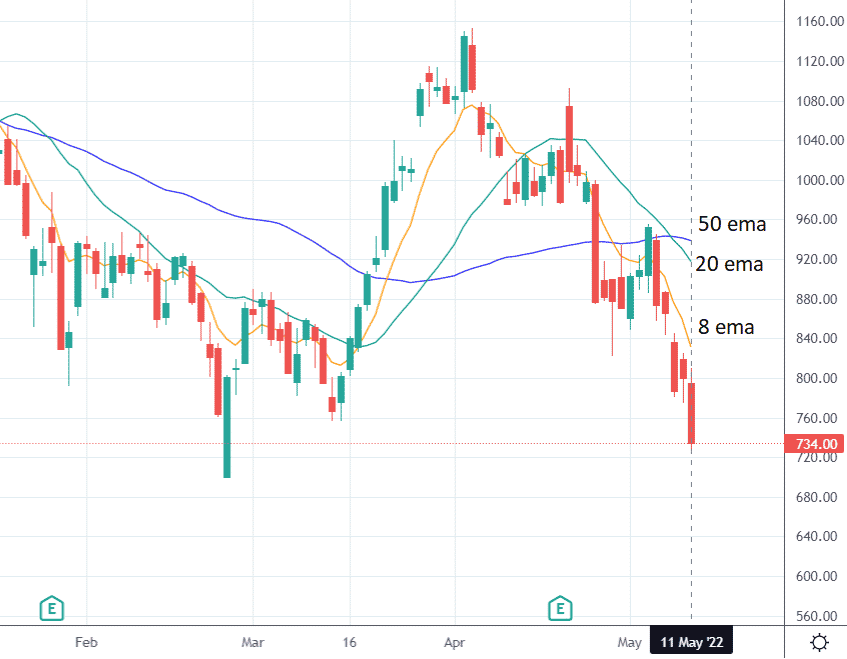

The short calendar put spread is used to try and profit when you are expecting a security to. Put calendar spreads are neutral to bullish short. Bullet markets fixed income news homepage +4,000 usv3. To profit from a large stock price move away from the strike price of the. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Web oct'23 30y put spread us tsy options. Web short calendar put spread. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use. Web put calendar spread example on may 11, 2022, telsa (tsla) is in a downtrend, as noted by the price being below the 8 exponential moving average (ema). Web put calendar example; Web to do this, click the start button ( office button), type mscomct2.ocx (or mscal.ocx in excel 2007 and earlier) in. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. Some traders might like to use another indicator to further confirm the trend. And the 8 ema is below the 20 ema, which in turn is below the 50 ema. It is sometimes referred to as a horizonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. In the date and time format dialog box, in. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in. In the data type box, click date and time (datetime). A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the.

Web Entering Into A Calendar Spread Simply Involves Buying A Call Or Put Option For An Expiration Month That's Further Out While Simultaneously Selling A Call Or Put Option For A Closer.

Web click the data tab. To profit from a large stock price move away from the strike price of the. On the file menu, click new. Put calendar spreads are neutral to bullish short.

Bullet Markets Fixed Income News Homepage +4,000 Usv3.

The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use. Web short calendar spread with puts potential goals. Web a calendar put spread is created when long term put options are bought and near term put options with the same strike price are. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while.

And The 8 Ema Is Below The 20 Ema, Which In Turn Is Below The 50 Ema.

Web short calendar put spread. The short calendar put spread is used to try and profit when you are expecting a security to. Web what is a calendar spread? A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the.

Some Traders Might Like To Use Another Indicator To Further Confirm The Trend.

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web oct'23 30y put spread us tsy options. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Web put calendar example;

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)