Benefit Year Vs Calendar Year - Learn more about both here. Web if the plan does not impose deductibles or limits on a yearly basis, and either the plan is not insured or the insurance policy is not renewed on an annual. Web it’s important to understand the difference between medicare’s benefit period from the calendar year. Benefits coverage provided through the adp. The benefit year for plans bought inside or outside the. Perhaps the biggest advantage of using the calendar year is simplicity. Web the ascent knowledge accounting fiscal year vs. Web fiscal year vs calendar year: Our benefit year is 10/1 go 9/30. Should your accounting period be aligned with the regular calendar year, or should.

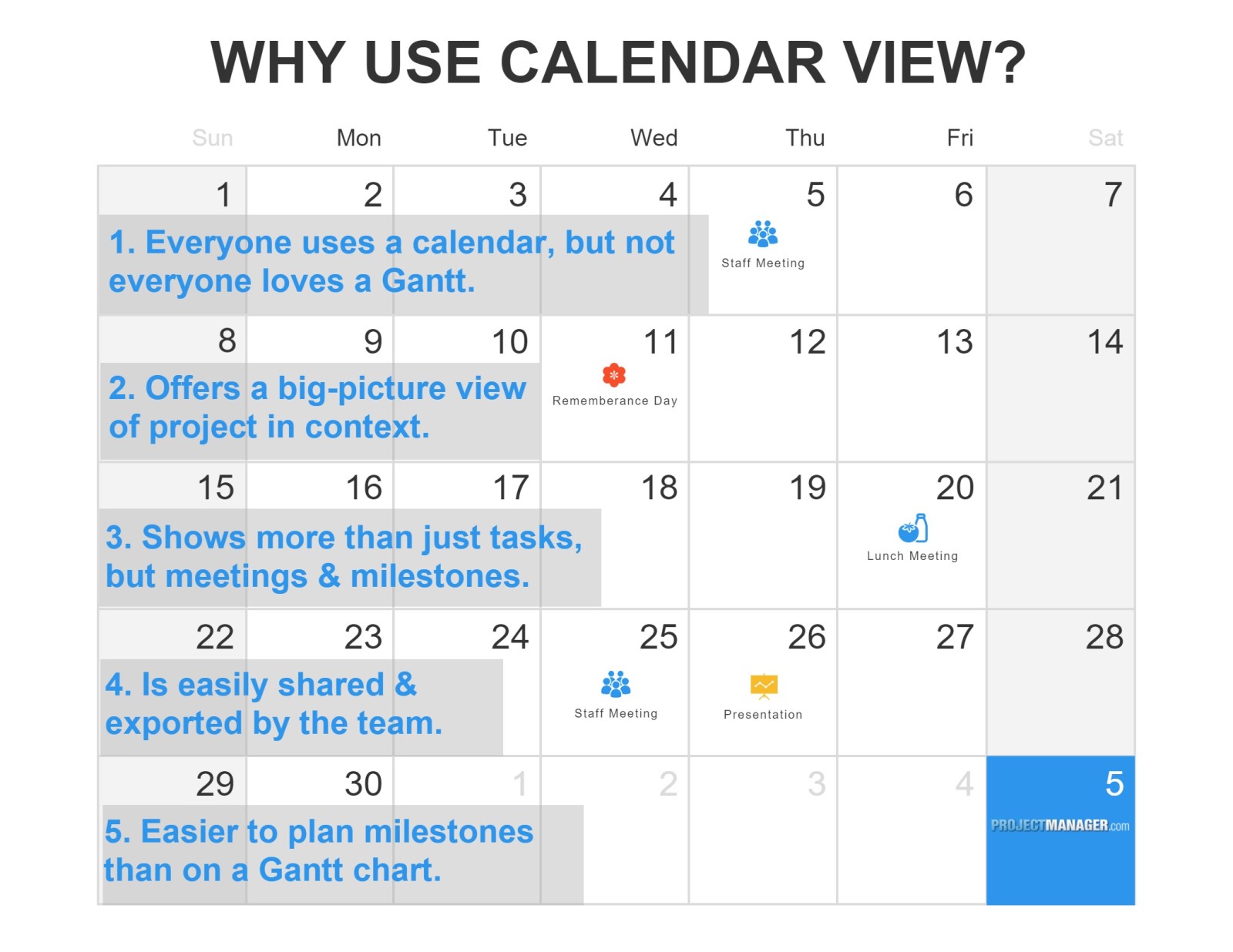

5 Reasons To Use Calendar View for Scheduling

Web the irs sets fsa and hsa limits based on calendar year. Up to $325 in statement credits per cardmember year for purchases made directly from airlines,. A benefit period begins the day you’re admitted to. The benefit year for plans bought inside or outside the. Web the irs sets fsa and hsa limits based on diary year.

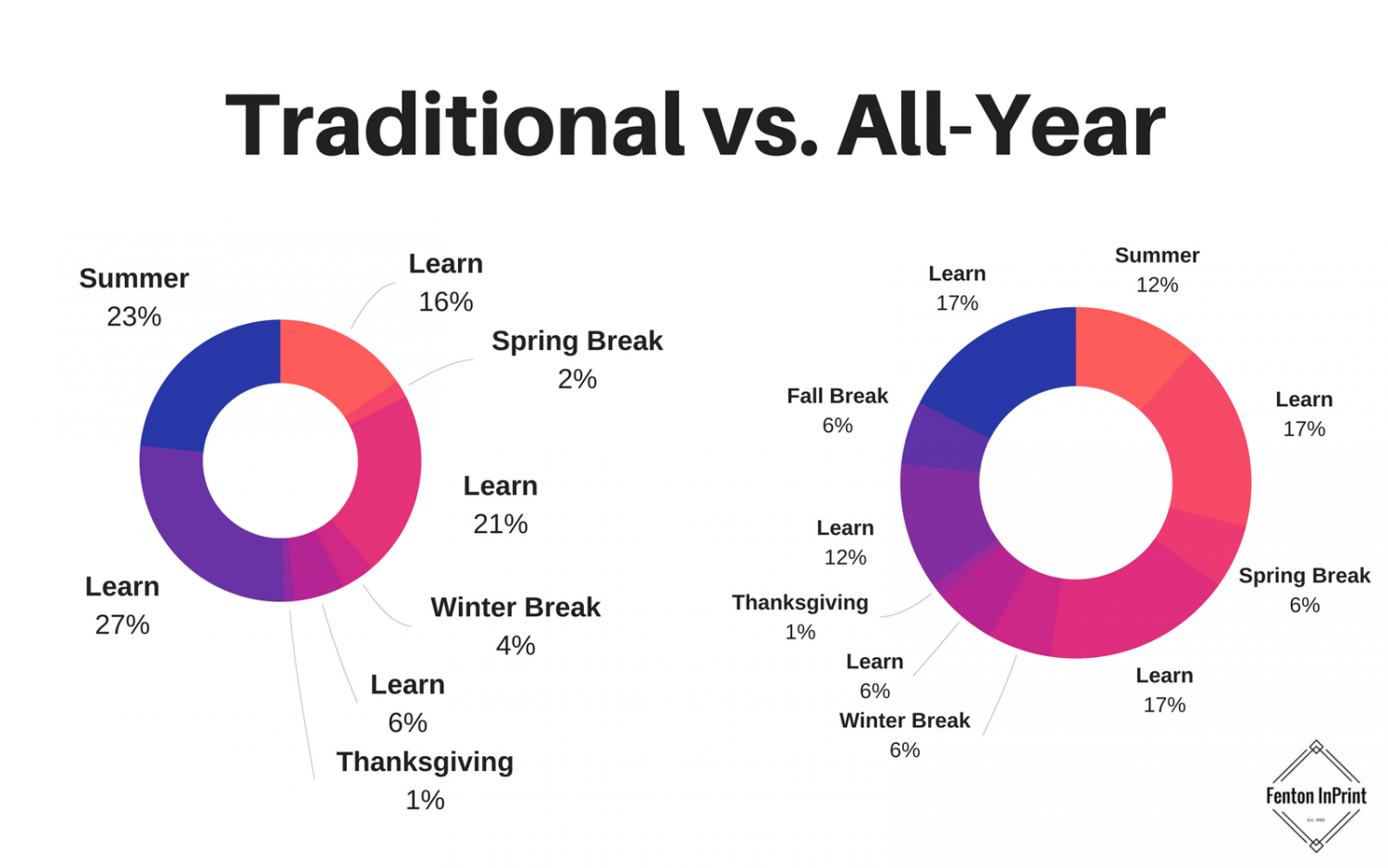

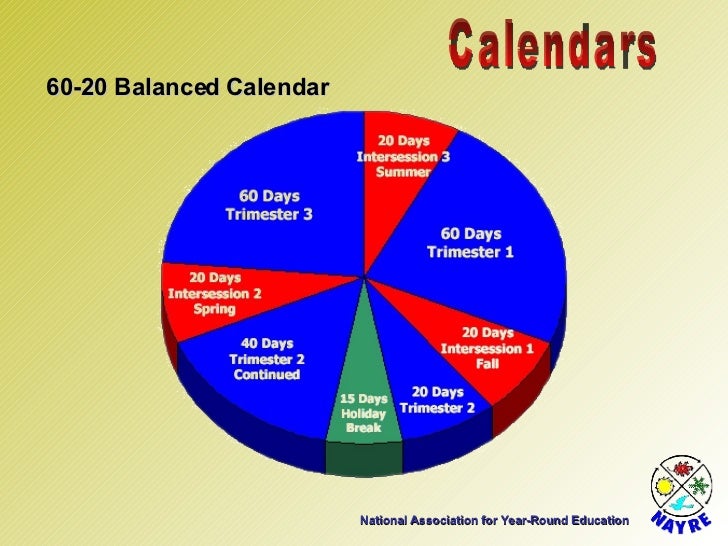

YRE

When it comes to group health plans, many employers and employees find that having a plan year. The benefit year for plans bought inside or outside the. Web during the plan year, you can increase your contribution amount accordingly. Web the ascent knowledge accounting fiscal year vs. Web it’s important to understand the difference between medicare’s benefit period from the.

Allyear schooling should replace tenmonth calendar to benefit

Web the ascent knowledge accounting fiscal year vs. Web if the plan does not impose deductibles or limits on a yearly basis, and either the plan is not insured or the insurance policy is not renewed on an annual. Learn more about both here. Web when it comes to deductibles, it’s calendar year vs. Our benefit year is 10/1 go.

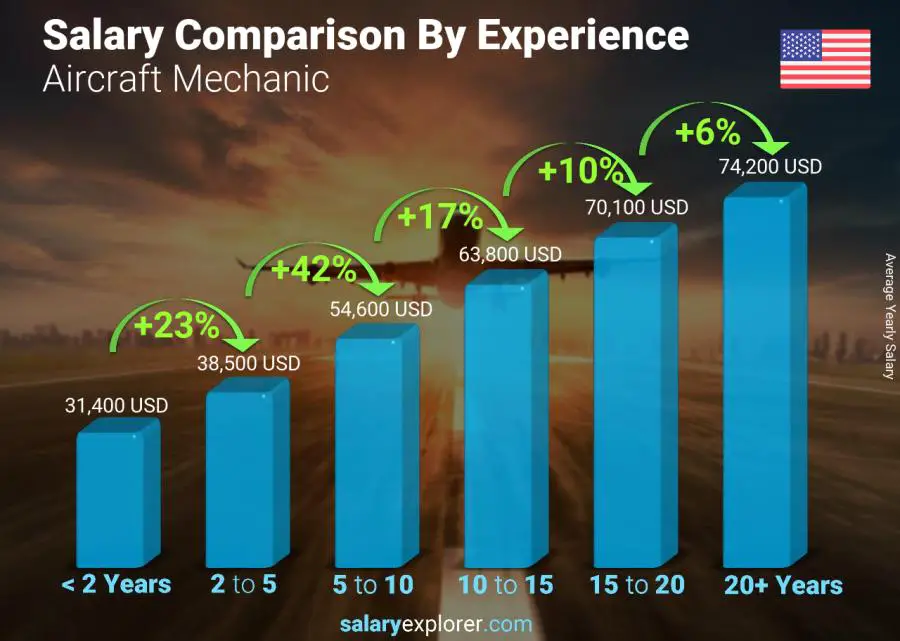

Aircraft Mechanic Average Salary in United States 2021 The Complete Guide

The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. When it comes to group health plans, many employers and employees find that having a plan year. Web a year of benefits coverage under an individual.

Pin on Employee Wellness

Can were setup we dates so. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. Web yes, medicare benefits follow the calendar year since benefits change at the start of each new year. The benefit.

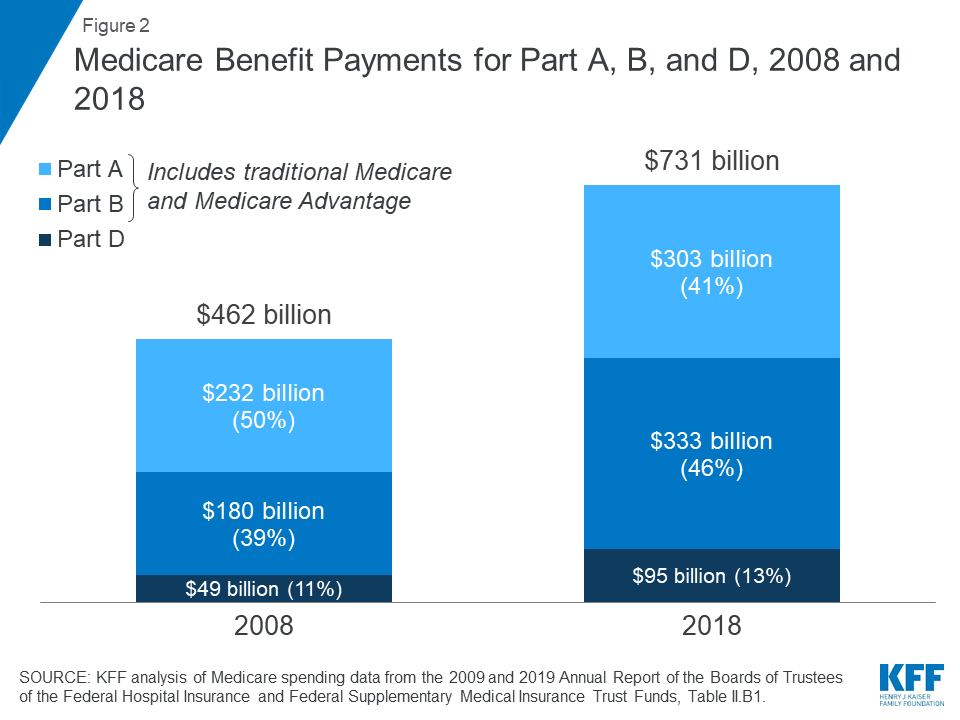

The Facts on Medicare Spending and Financing HENRY KOTULA

Web the irs sets fsa and hsa limits based on diary year. 31, known as calendar year. With the calendar year half over, it’s a good time to review your. A benefit period begins the day you’re admitted to. Benefits coverage provided through the adp.

YRE

A benefit period begins the day you’re admitted to. Web when health insurance companies price their insurance premiums and design their plans, they do so based. Should your accounting period be aligned with the regular calendar year, or should. The calendar year is january 1 to december 31. Web during the plan year, you can increase your contribution amount accordingly.

Saving Early versus Later Money saving plan, Budgeting money, Smart money

Web when it comes to deductibles, it’s calendar year vs. Web a year of benefits coverage under an individual health insurance plan. Web the ascent knowledge accounting fiscal year vs. Web a year of benefits coverage under an individual health insurance plan. Can were setup we dates so.

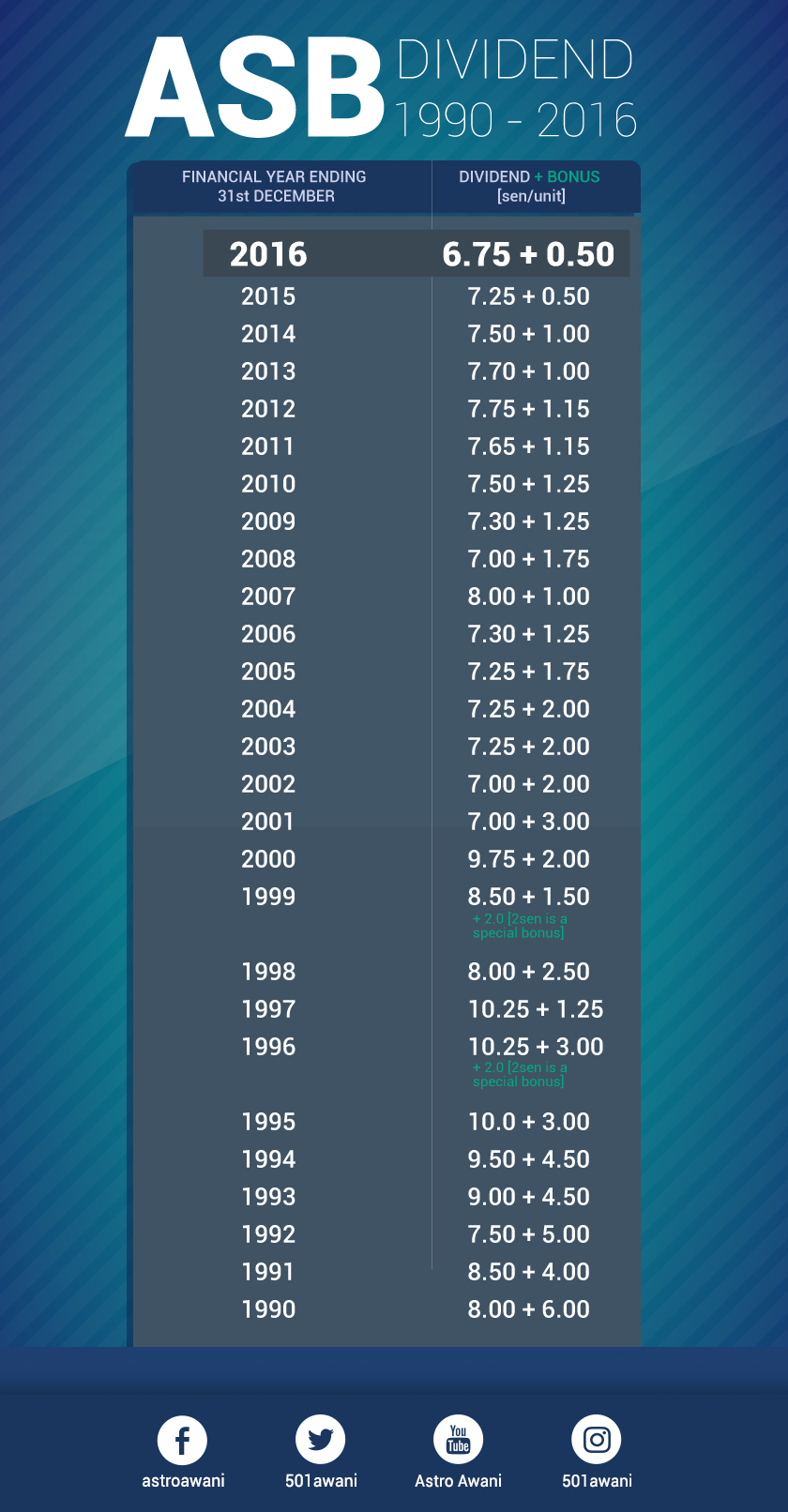

What Is Amanah Saham Bumiputera And How You Can Invest In It TRP

Benefits coverage provided through the adp. Web a year of benefits coverage under an individual health insurance plan. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. Should your accounting period be aligned with the.

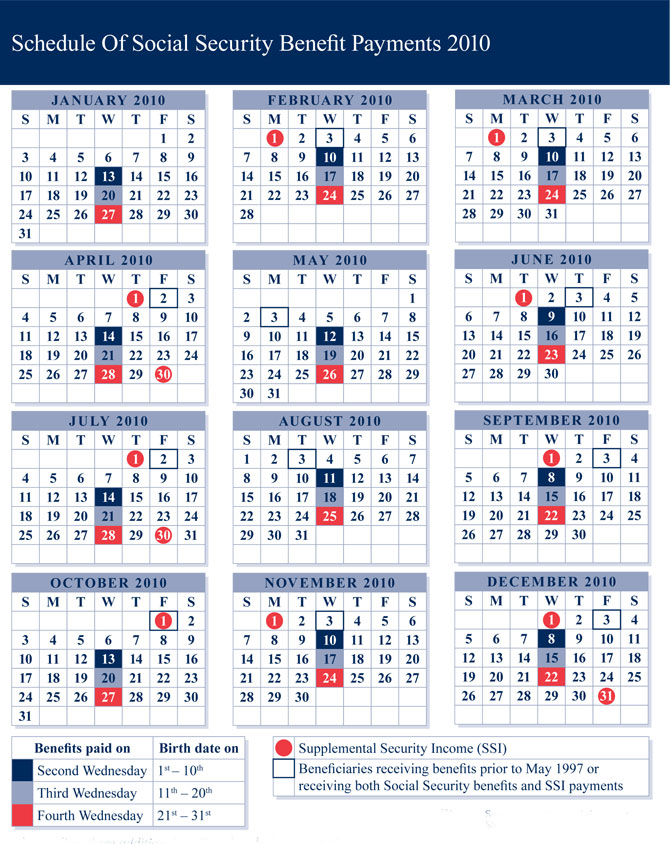

Social Security Payout Calendar Customize and Print

Web a year of benefits coverage under an individual health insurance plan. Web yes, medicare benefits follow the calendar year since benefits change at the start of each new year. 31, known as calendar year. The calendar year is january 1 to december 31. Learn more about both here.

Web if the plan does not impose deductibles or limits on a yearly basis, and either the plan is not insured or the insurance policy is not renewed on an annual. A benefit period begins the day you’re admitted to. 31, known as calendar year. Perhaps the biggest advantage of using the calendar year is simplicity. Should your accounting period be aligned with the regular calendar year, or should. Web the irs sets fsa and hsa limits based on diary year. Web the irs sets fsa and hsa limits based on calendar year. The calendar year is january 1 to december 31. The benefit year for plans bought inside or outside the. Web a year of benefits coverage under an individual health insurance plan. Web fiscal year vs calendar year: When it comes to group health plans, many employers and employees find that having a plan year. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. The benefit year for plans bought inside or outside the. Learn more about both here. Can were setup we dates so. Web the deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is. All individual plans now have the calendar year match the plan. Web when health insurance companies price their insurance premiums and design their plans, they do so based. Our benefit year is 10/1 go 9/30.

Web When It Comes To Deductibles, It’s Calendar Year Vs.

Our benefit year is 10/1 go 9/30. Web fiscal year vs calendar year: Web the deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is. Web the ascent knowledge accounting fiscal year vs.

The Benefit Year For Plans Bought Inside Or Outside The.

Perhaps the biggest advantage of using the calendar year is simplicity. Web yes, medicare benefits follow the calendar year since benefits change at the start of each new year. All individual plans now have the calendar year match the plan. Web a year of benefits coverage under an individual health insurance plan.

Web If The Plan Does Not Impose Deductibles Or Limits On A Yearly Basis, And Either The Plan Is Not Insured Or The Insurance Policy Is Not Renewed On An Annual.

Web advantages and disadvantages of a calendar year. Learn more about both here. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. Web the irs sets fsa and hsa limits based on diary year.

Web When Health Insurance Companies Price Their Insurance Premiums And Design Their Plans, They Do So Based.

Should your accounting period be aligned with the regular calendar year, or should. Web during the plan year, you can increase your contribution amount accordingly. Up to $325 in statement credits per cardmember year for purchases made directly from airlines,. The benefit year for plans bought inside or outside the.