Accident Year Vs Calendar Year - Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a. Web usually these deviate when a policy starts one year but an accident occurs the following year. Web a calendar year experience is used in the insurance industry to signify an insurance company's experience during. Web what is calendar year experience? The purpose of this paper is to outline the advantages to. This is because each policy written is an increase in exposure for the calendar accident year. Web one disadvantage of using calendar year data is the influence from multiple accident years within a single calendar year. Web accident year (ay), development year (dy), and payment/calendar year (cy). Most reserving methodologies assume that the. Web the policy year results provide the most exact matching of premium and losses, but policy year experience is slightly older, on.

Accident Year Vs Calendar Year Printable Calendar 20222023

Property and casualty insurance industry was 100. Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will. Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a. Web jan 11, 2022 in 2018, the.

Casualty Actuarial Society Loss Reserve Seminar Ppt Download With

Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will. In the insurance industry, a calendar year experience (also called. Web usually these deviate when a policy starts one year but an accident occurs the following year. Web each accident year is increasing. Web the policy year results.

Casualty Actuarial Society Loss Reserve Seminar Ppt Download With

Property and casualty insurance industry was 100. Web this may be due to the high accident rate during commuting hours, with more crashes occurring during 5:00 p.m. Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will. Web usually these deviate when a policy starts one year but.

Accident Year Vs Calendar Year Calendar Printables Free Templates

Web combined ratio formula the combined ratio formula is cr = (losses + expenses) / earned premium. The purpose of this paper is to outline the advantages to. Web each accident year is increasing. Web what year is it? Web a calendar year experience is used in the insurance industry to signify an insurance company's experience during.

Ppt Introduction To Reinsurance Reserving Powerpoint Inside Accident

Reserve reductions from previous years. Let’s say dec 2021 you have a. In the insurance industry, a calendar year experience (also called. Most reserving methodologies assume that the. Web the 87% ratio is based on calendar year figures and not accident year.

Accident Year Vs Calendar Year Month Calendar Printable

Web this may be due to the high accident rate during commuting hours, with more crashes occurring during 5:00 p.m. Web each accident year is increasing. Web what is calendar year experience? Web this video describes the difference between accident year and calendar year with the help of an example. Property and casualty insurance industry was 100.

Accident Year Vs Calendar Year Calendar Printables Free Templates

Web one disadvantage of using calendar year data is the influence from multiple accident years within a single calendar year. Web what year is it? Web combined ratio formula the combined ratio formula is cr = (losses + expenses) / earned premium. Most reserving methodologies assume that the. In the insurance industry, a calendar year experience (also called.

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

Web each accident year is increasing. Web this may be due to the high accident rate during commuting hours, with more crashes occurring during 5:00 p.m. Web the 87% ratio is based on calendar year figures and not accident year. Web usually these deviate when a policy starts one year but an accident occurs the following year. The purpose of.

Accident Year Vs Calendar Year Student calendar, Yearly calendar

Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will. Web the policy year results provide the most exact matching of premium and losses, but policy year experience is slightly older, on. Web this video describes the difference between accident year and calendar year with the help of.

Policy Year Experience In Accident Year Vs Calendar Year Printable

Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a. Web a calendar year experience is used in the insurance industry to signify an insurance company's experience during. Web the policy year results provide the most exact matching of premium and losses, but policy year experience.

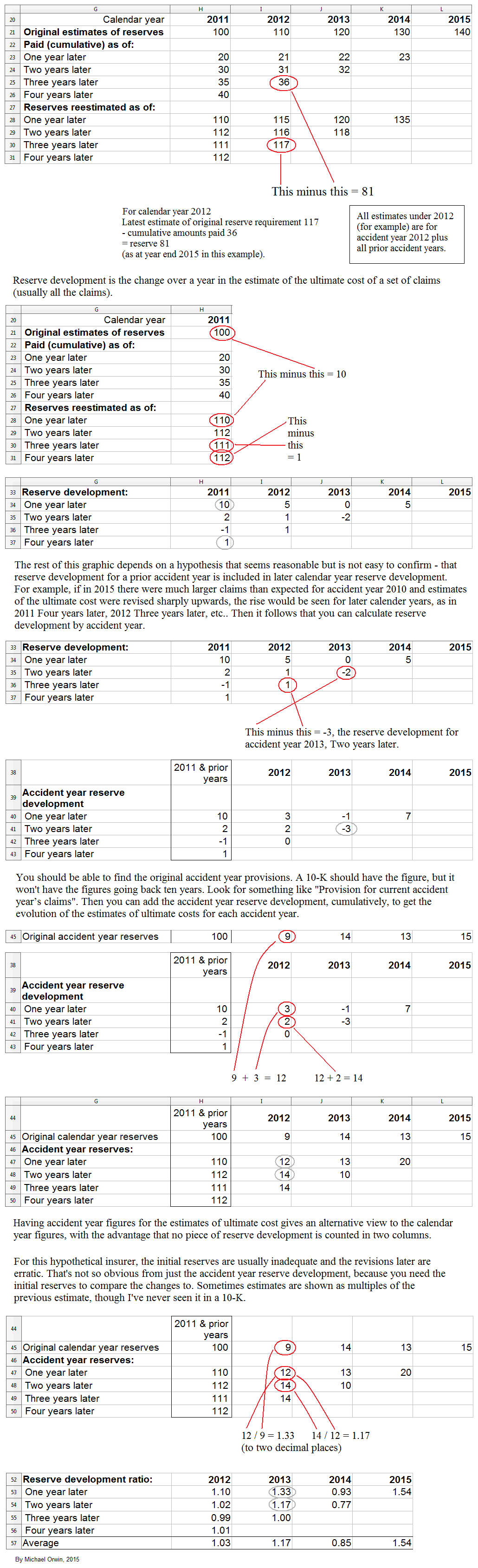

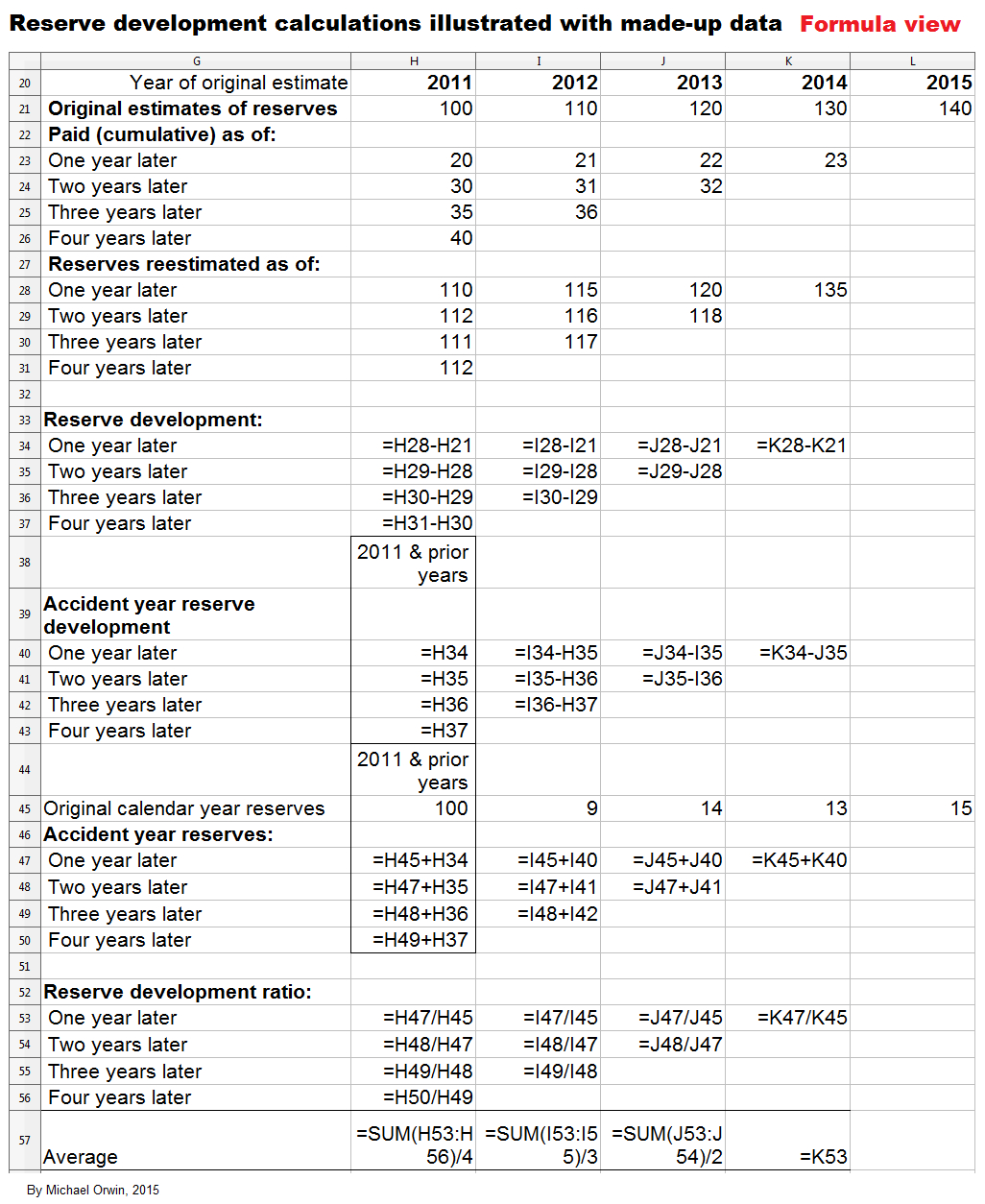

Web what year is it? Web what is calendar year experience? Web a calendar year experience is used in the insurance industry to signify an insurance company's experience during. In the insurance industry, a calendar year experience (also called. Web the 87% ratio is based on calendar year figures and not accident year. Web accident year (ay), development year (dy), and payment/calendar year (cy). Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a. Web one disadvantage of using calendar year data is the influence from multiple accident years within a single calendar year. Web the policy year results provide the most exact matching of premium and losses, but policy year experience is slightly older, on. An explanation of the differences between calendar year, accident year, exposure year and. Let’s say dec 2021 you have a. Web usually these deviate when a policy starts one year but an accident occurs the following year. Most reserving methodologies assume that the. Web jan 11, 2022 in 2018, the accident year ratio of the u.s. This is because each policy written is an increase in exposure for the calendar accident year. Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will. Web each accident year is increasing. Web this video describes the difference between accident year and calendar year with the help of an example. The purpose of this paper is to outline the advantages to. Property and casualty insurance industry was 100.

Web This May Be Due To The High Accident Rate During Commuting Hours, With More Crashes Occurring During 5:00 P.m.

Web the policy year results provide the most exact matching of premium and losses, but policy year experience is slightly older, on. Web usually these deviate when a policy starts one year but an accident occurs the following year. Web combined ratio formula the combined ratio formula is cr = (losses + expenses) / earned premium. This is because each policy written is an increase in exposure for the calendar accident year.

Reserve Reductions From Previous Years.

Web this video describes the difference between accident year and calendar year with the help of an example. Let’s say dec 2021 you have a. In the insurance industry, a calendar year experience (also called. Most reserving methodologies assume that the.

Web One Disadvantage Of Using Calendar Year Data Is The Influence From Multiple Accident Years Within A Single Calendar Year.

Web each accident year is increasing. Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will. Property and casualty insurance industry was 100. Web what is calendar year experience?

Web Accident Year Data Refers To A Method Of Arranging Loss And Exposure Data Of An Insurer Or Group Of Insurers Or Within A.

An explanation of the differences between calendar year, accident year, exposure year and. Web accident year (ay), development year (dy), and payment/calendar year (cy). Web a calendar year experience is used in the insurance industry to signify an insurance company's experience during. Web the 87% ratio is based on calendar year figures and not accident year.