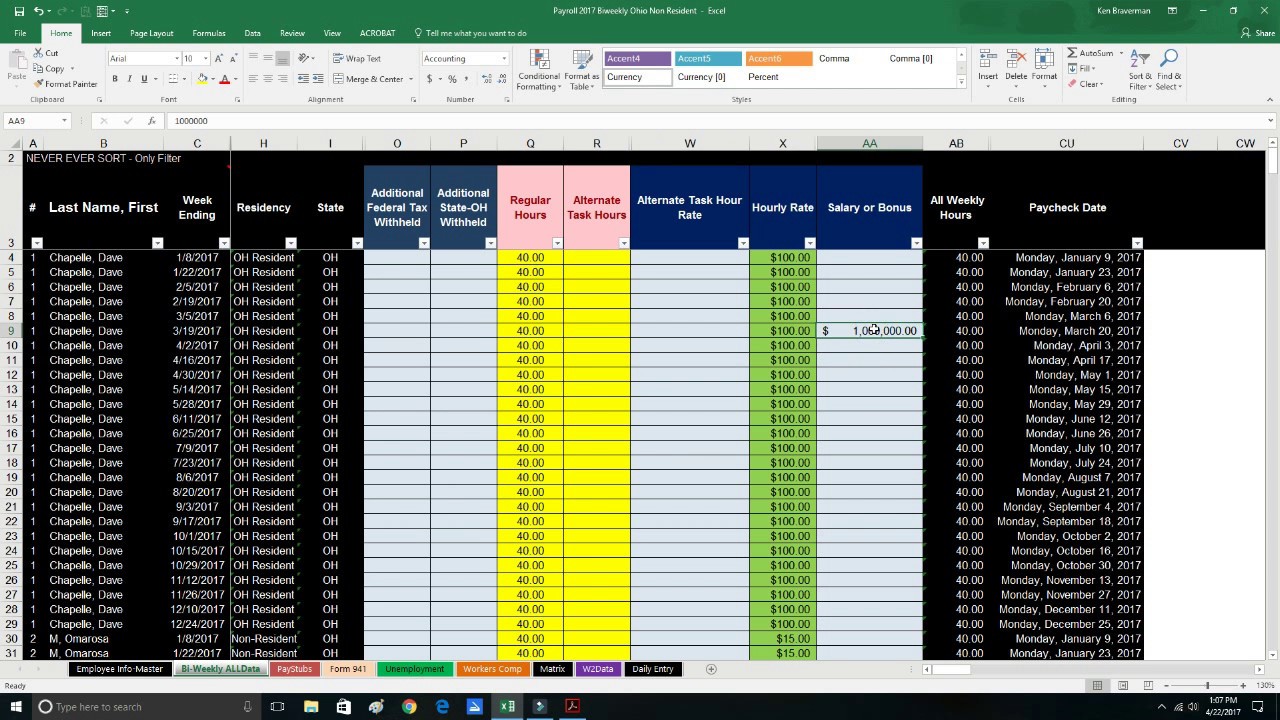

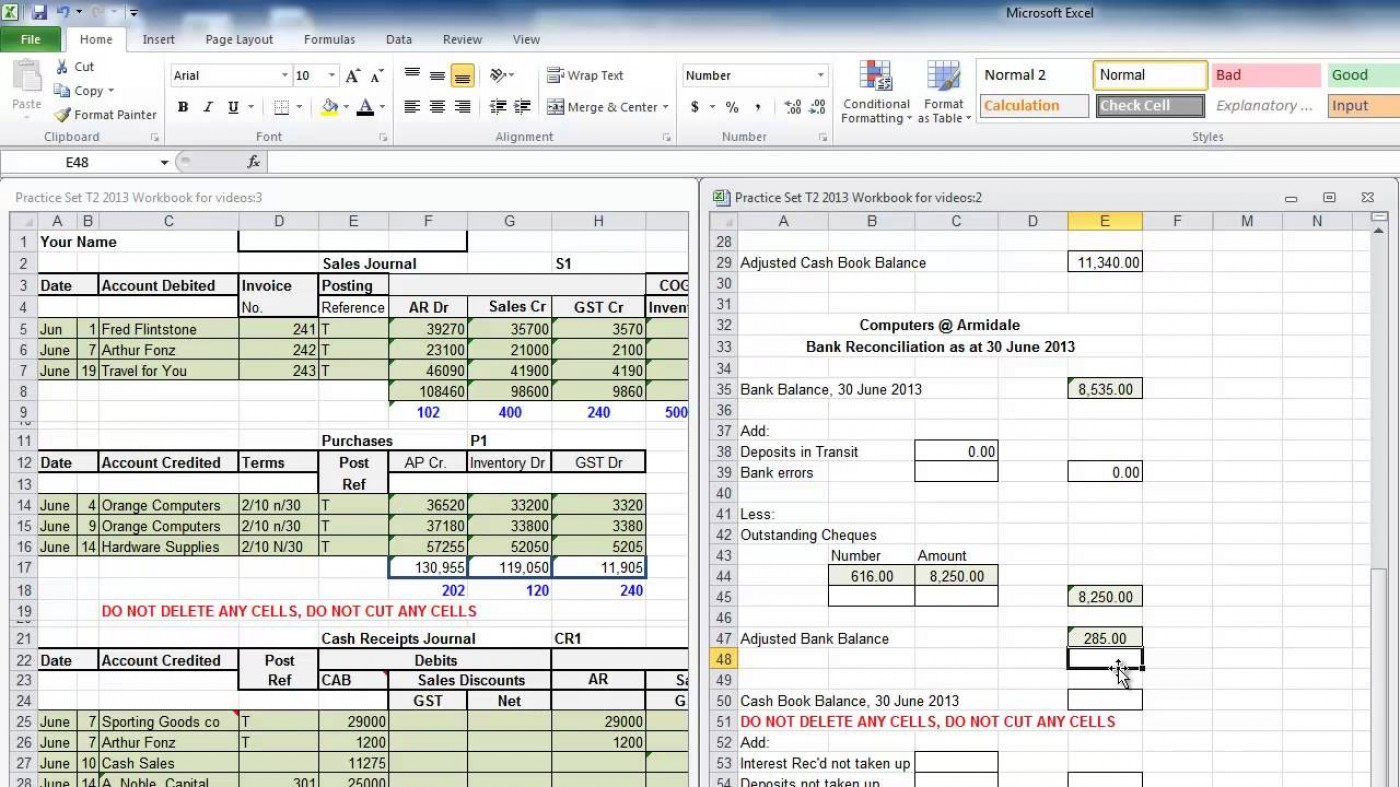

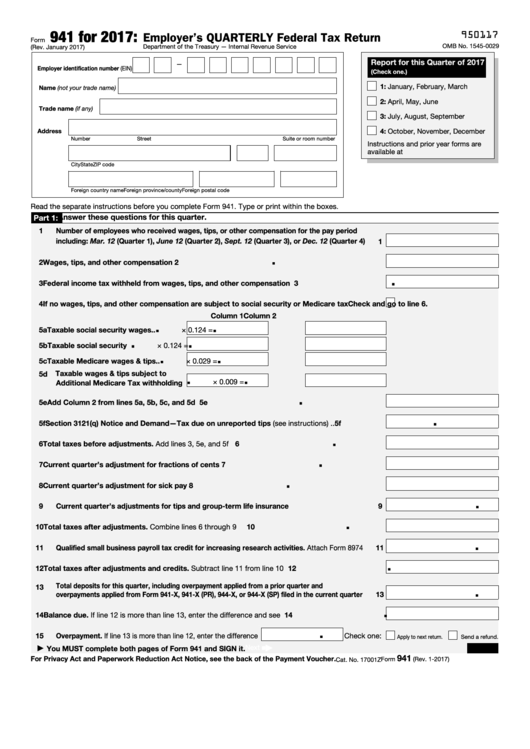

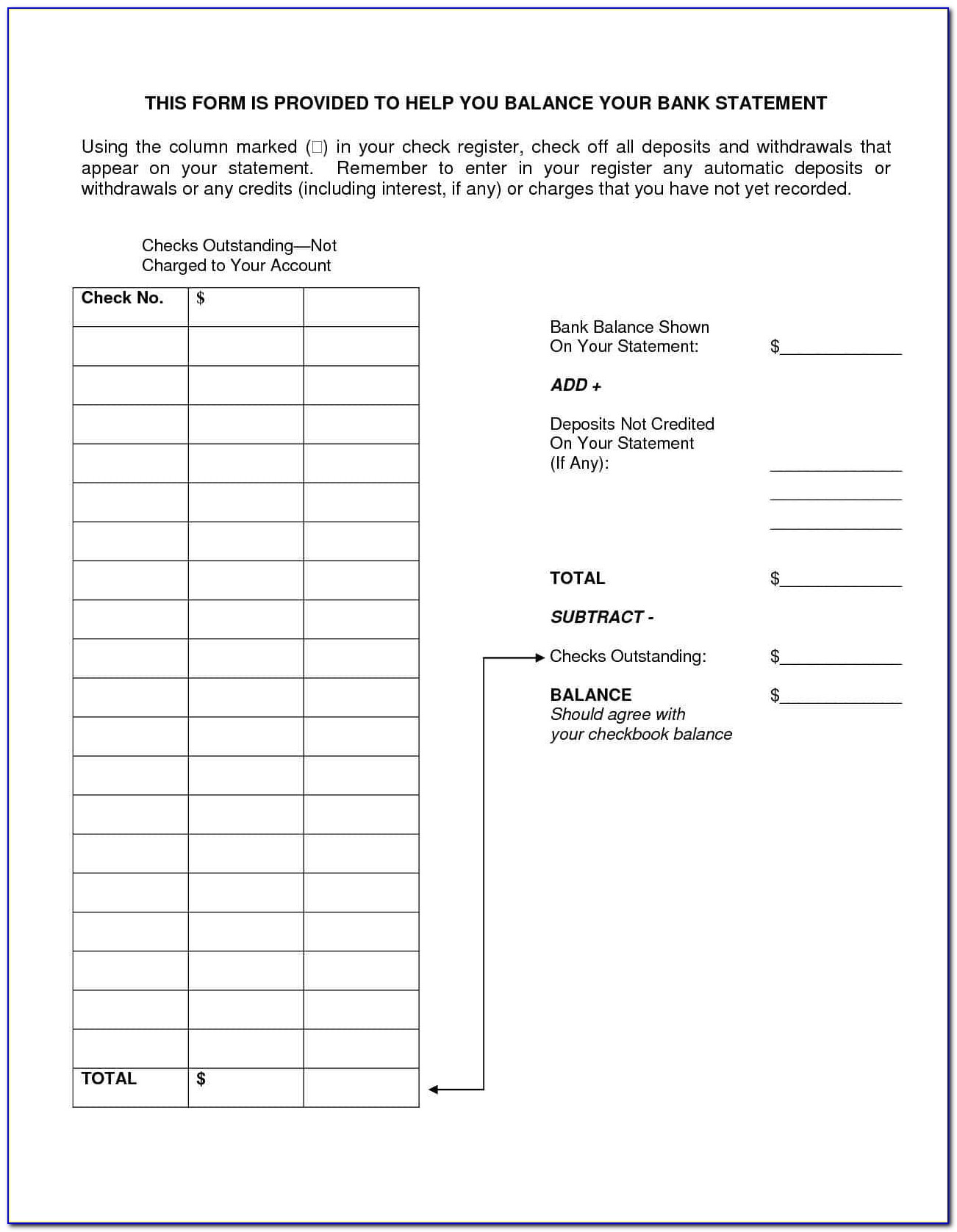

941 Reconciliation Template Excel - Compare those figures with the totals reported on all four 941s for the. Web current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments early termination of the. From the “enter tax return” portal page, click the ri bulk 941. Web completion of the payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Does my general ledger match my payroll expenses? Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. Web ðï ࡱ á> þÿ 1. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation. You can customize all of the.

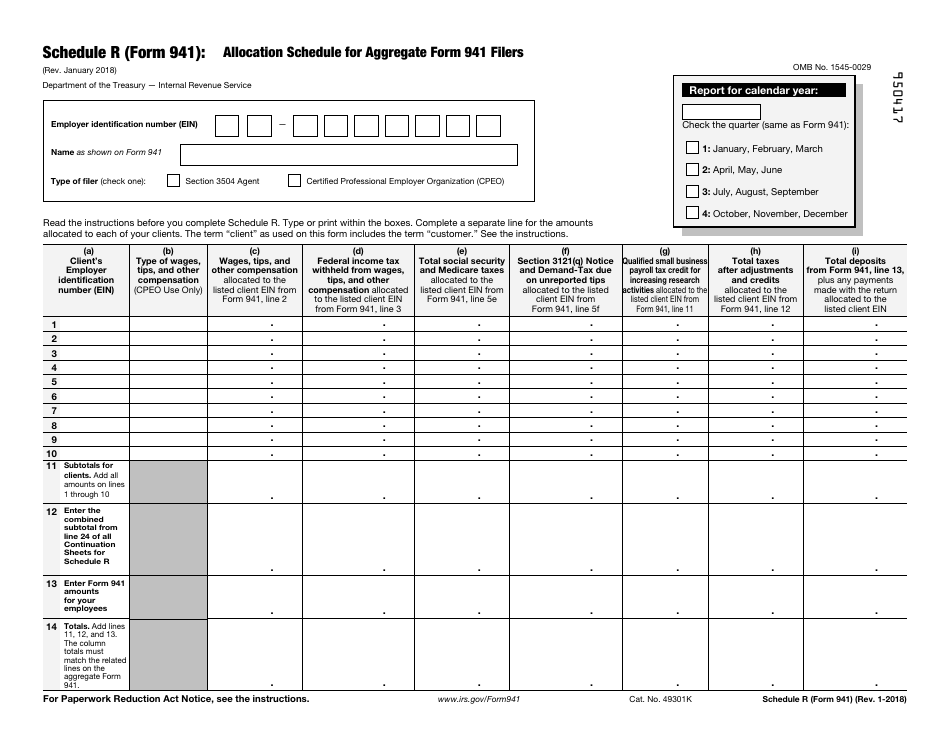

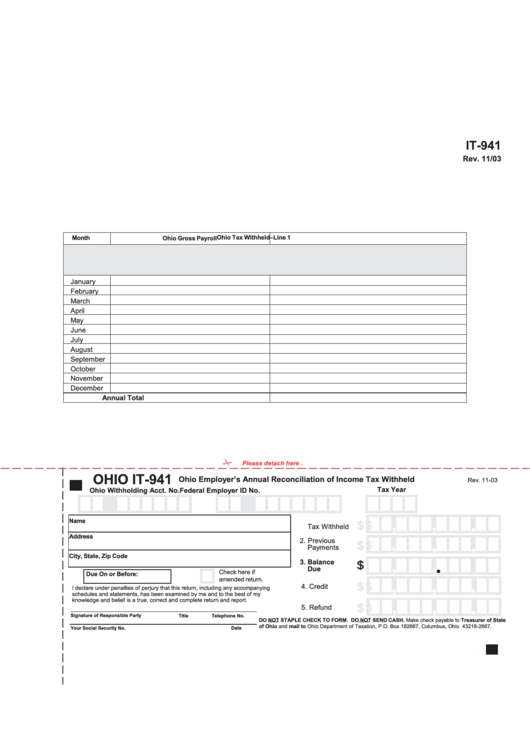

IRS Form 941 Schedule R Download Fillable PDF or Fill Online Allocation

To help business owners calculate the tax credits they are eligible for, the irs has created. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. Your total payroll expenses must match what you’ve. Run a report that shows annual payroll amounts. Web completion of payroll reconciliation usually results in.

QuickBooks Payroll Liability reports and troubleshooting

Web utah annual withholding reconciliation excel instructions. Web how to use the gl payroll reconciliation tool. Compare those figures with the totals reported on all four 941s for the. If these forms are not in balance, penalties from the irs. Your total payroll expenses must match what you’ve.

How to File Quarterly Form 941 Payroll in Excel 2017 YouTube

Web read the separate instructions before you complete form 941. Compare those figures with the totals reported on all four 941s for the. Run a report that shows annual payroll amounts. To help business owners calculate the tax credits they are eligible for, the irs has created. Web utah annual withholding reconciliation excel instructions.

Inventory Reconciliation Format In Excel Excel Templates

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Does my general ledger match my payroll expenses? Compare those figures with the totals reported on all four 941s for the. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”).

Simplify your US Payroll reconciliation, and save hundreds of hours

To help business owners calculate the tax credits they are eligible for, the irs has created. Web completion of the payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. Compare those figures with the totals reported on all four 941s for the. Web read the separate instructions before you complete form 941. Web reconciliation templates.

106 Form 941 Templates free to download in PDF, Word and Excel

Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation. Compare those figures with the totals reported on all four 941s for the. Web use the march 2023 revision of form 941 to report taxes for the first quarter.

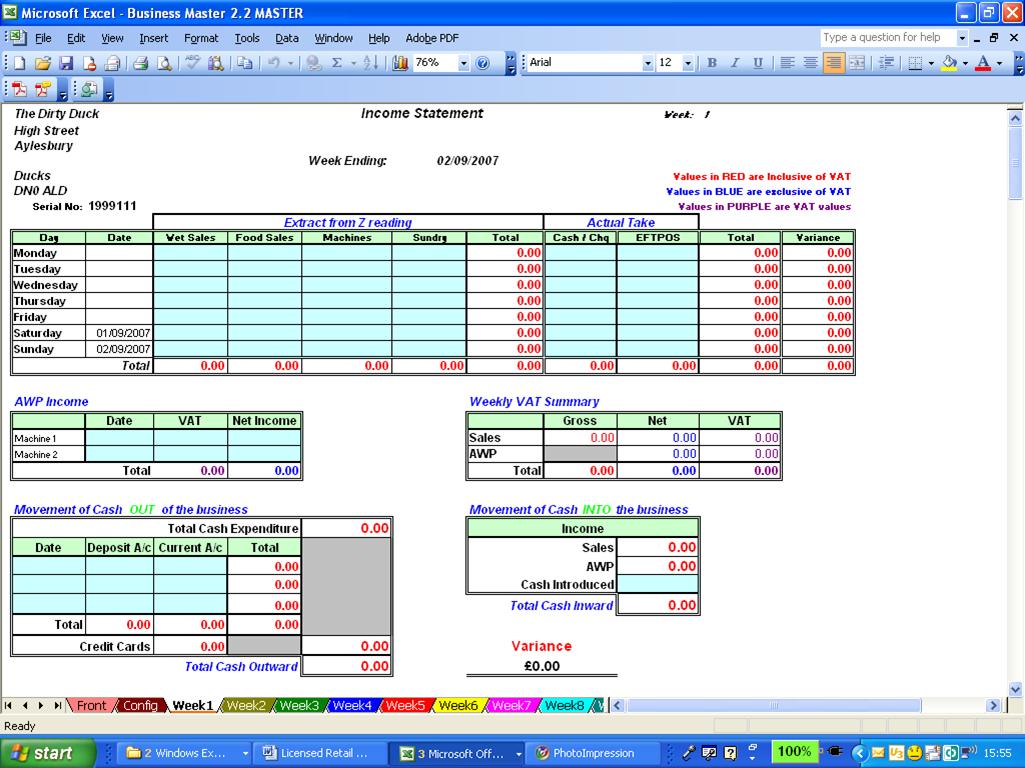

Bank Reconciliation Excel Spreadsheet Google Spreadshee bank

Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. Web how to use the gl payroll reconciliation tool. You can customize all of the. Form 941 excel template 2020. Does my general ledger match my payroll expenses?

Vat Reconciliation Spreadsheet —

Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation. Does my general ledger match my payroll expenses? The goal is to confirm. Web ðï ࡱ á> þÿ 1. Web if you need to prepare a ri bulk 941 file, follow these steps:

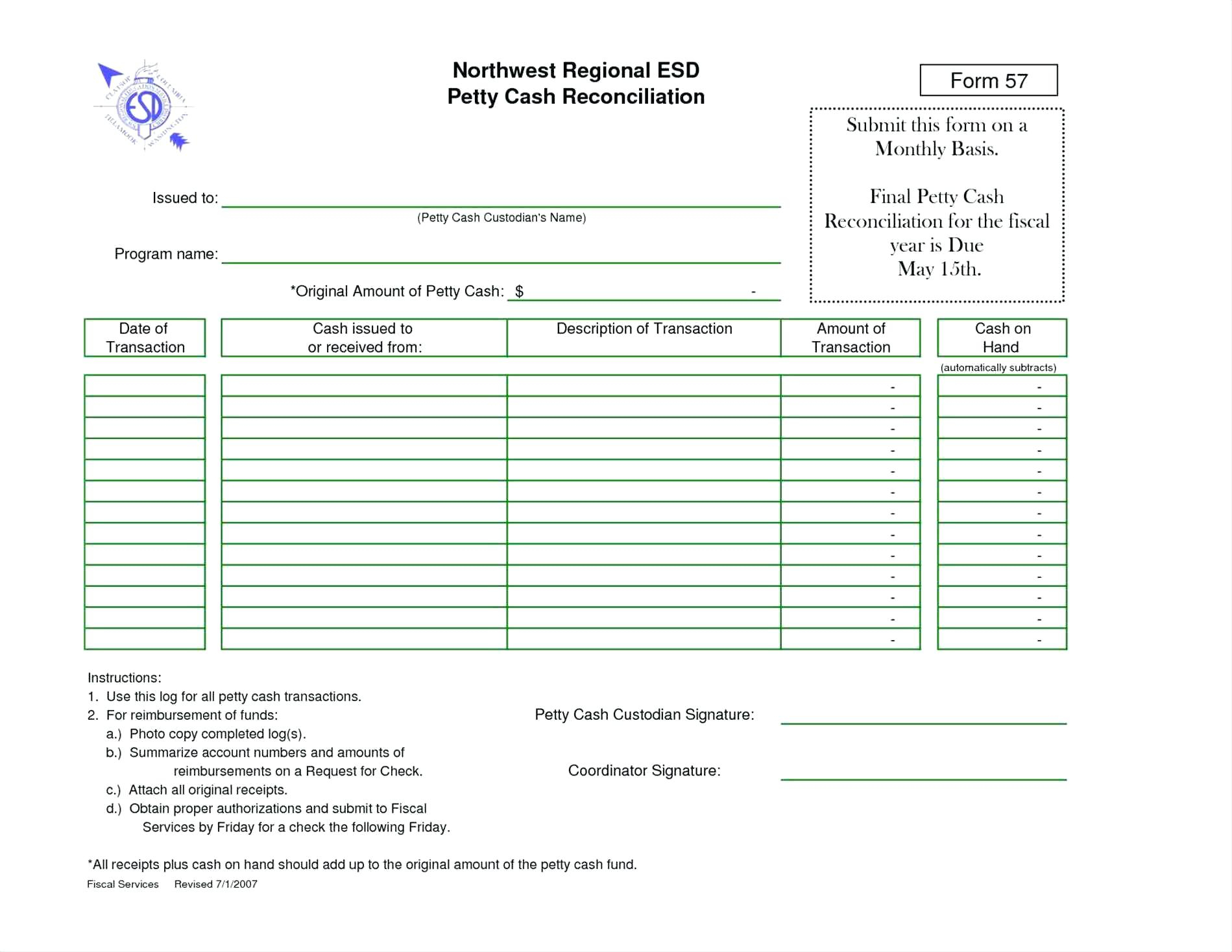

Form It941 Employer'S Annual Reconciliation Of Tax Withheld

From the “enter tax return” portal page, click the ri bulk 941. Does my general ledger match my payroll expenses? Web completion of the payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. To help business owners calculate the tax credits they are eligible for, the irs has created. You can customize all of the.

Daily Cash Reconciliation Excel Template

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on. Compare those figures with the totals reported on all.

Web form 941 worksheet for 2022. Your total payroll expenses must match what you’ve. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; From the “enter tax return” portal page, click the ri bulk 941. Does my general ledger match my payroll expenses? Web utah annual withholding reconciliation excel instructions. If these forms are not in balance, penalties from the irs. Web completion of payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly forms 941 or. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on. Web read the separate instructions before you complete form 941. You can customize all of the. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation. Form 941 excel template 2020. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Compare those figures with the totals reported on all four 941s for the. To help business owners calculate the tax credits they are eligible for, the irs has created. Web completion of the payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. Web ðï ࡱ á> þÿ 1.

Web Reconciliation Templates Excel Make Reconciliation Documents With Template.net's Free Reconciliation.

Form 941 excel template 2020. Does my general ledger match my payroll expenses? Web completion of the payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. The goal is to confirm.

Web Read The Separate Instructions Before You Complete Form 941.

Web completion of payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly forms 941 or. Web current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments early termination of the. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. You can customize all of the.

If These Forms Are Not In Balance, Penalties From The Irs.

Web how to use the gl payroll reconciliation tool. To help business owners calculate the tax credits they are eligible for, the irs has created. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. Run a report that shows annual payroll amounts.

Web Utah Annual Withholding Reconciliation Excel Instructions.

Type or print within the boxes. Compare those figures with the totals reported on all four 941s for the. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Your total payroll expenses must match what you’ve.